WHY YOU REALLY DON’T WANT A FAKE GUCCI

TODAY’S BLOG

WHY YOU REALLY DON’T WANT A FAKE GUCCI

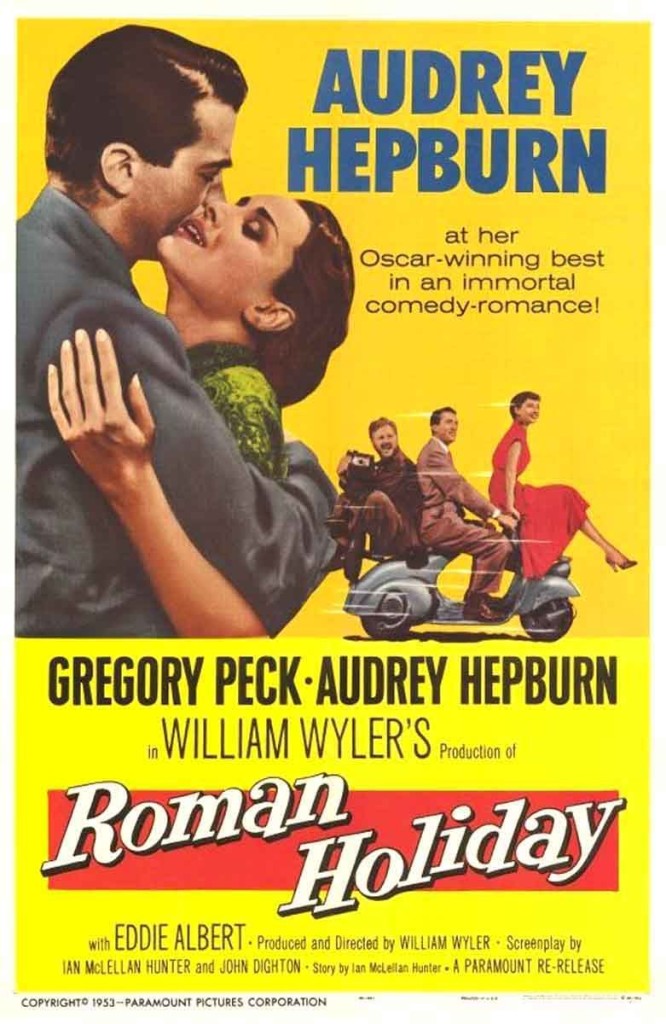

I imagine you have been around long enough to know the name of fashion house Gucci; you are likely to have come across the occasional Gucci store in one of our big cities or at an airport, the familiar logo and green/burgundy stripes. I very much doubt that your first experience of Gucci is a poster for the new film by Ridley Scott, who once again proves an inability for editing a film under 2 hours, which is a little amusing when there isn’t a single stitch or fabric cut in the film either.

Anyway, I did not know the story of Gucci (sorry) and to be plain, I am not sure I do now. The Romans were responsible for many myths and yet it appears that successful families in Italia (and elsewhere) continue to ignore all the warnings about families, legacy and wealth.

Despite its length, I enjoyed the telling of a family determined to self-destruct, failing to communicate about anything important, all the while offering the appearance of family unity. The hills of Rome, Tuscany or Milan are insufficient to bury the deeply seated gripes that one branch has against the other. Like lonely Jupiter, judging from on high, nursing grievances about the trivial yet punishing with wrath.

THE OBSESSION WITH CONTROL

It often all boils down to control. We are all probably tempted to believe that we have rather more control over things than we really do. Money corrupts most people, not everyone. I would suggest that it is more likely to corrupt those that seek to control (or power).

I believe that there is very little in life that we can control. I say this as a planner, presumably yours. Hopefully you have heard me say something like this before. I cannot control the markets (nobody really thinks that I can) I cannot control the future and I certainly cannot control who is elected and the policies that are introduced. We can all agree on this. Yet the truth is we cannot control very much of anything. We can try, we can plan, we can prepare, we can repeat, learn, gain experience but I cannot even really control how my body reacts or functions. I know its not popular to say so, but that doesn’t make it untrue.

Acknowledging how little I can actually control has been a lifelong journey for me, one that I suspect and hope is far from over. Obviously within a financial planning context we have “controls” and monitor these, responding appropriately based upon accumulated experience. Truthfully, we control costs as far as possible (I cannot control what others charge). We control asset allocation within a comfortable range. We control our own output, but not entirely devoid of externalities that dictate a degree of what makes up “advice”.

CATWALK VALUES

To my mind, we focus on what is important and attempt to encourage our clients to do the same – whatever “important” means to you. In the main, the common themes are relationships and a self-identity, not yachts, grand gestures or bank balances. Yet we cannot control relationships either, at least, not in any healthy way. The uncomfortable truth is that it has something to do with letting go. Something our clients have to sit with on occasion, letting go of control, trusting our advice and processes to ultimately come good. This is always easier to do when things are going well and tested when they do not.

Sadly, the Gucci family, at least in the film-story, forgot all that was important. The fake Gucci bags being a metaphor for their own lives. Quality comes from crafted time, not short-cuts. I’d suggest that the things that are truly important to you are products of time, probably many, many years.

The House of Gucci is streaming at a platform to your living room. The makeup is certainly impressive. Here is the trailer, the film stars Lady Gaga, Adam Driver, Al Pacino, Jeremy Irons, Salma Hayek and Jared Leto.

Dominic Thomas

Solomons IFA

You can read more articles about Pensions, Wealth Management, Retirement, Investments, Financial Planning and Estate Planning on my blog which gets updated every week. If you would like to talk to me about your personal wealth planning and how we can make you stay wealthier for longer then please get in touch by calling 08000 736 273 or email info@solomonsifa.co.uk

GET IN TOUCH

Solomon’s Independent Financial Advisers

The Old Bakery, 2D Edna Road, Raynes Park, London, SW20 8BT

Email – info@solomonsifa.co.uk

Call – 020 8542 8084

GET IN TOUCH

Solomon’s Independent Financial Advisers

The Old Bakery, 2D Edna Road, Raynes Park, London, SW20 8BT

Email – info@solomonsifa.co.uk Call – 020 8542 8084