SELF EMPLOYED V LTD CO.

TODAY’S BLOG

SELF EMPLOYED v LTD COMPANY

Those of you that run a small business or provide a professional service are typically either self-employed or operate a small Limited company. The main legal advantage of a Limited company is that any liability is limited to the company and the Director cannot be harassed for funds owed to creditors should the business fail. The company is a legal entity in it own right.

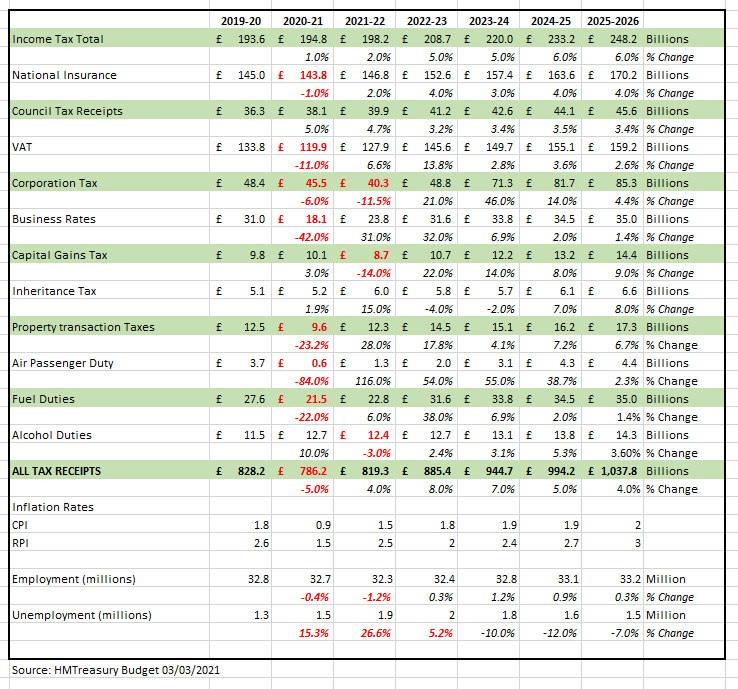

The Chancellor’s plan to increase the main corporation tax rate from 19% to 25% in April 2023 has once again brought into focus the question of whether it makes sense to incorporate your business if you are currently self-employed. Although tax alone should not be the determinant, it can be a major factor in many instances.

CRUNCHING THE NUMBERS

The first point to note is that the 25% rate will generally only apply for companies with profits of at least £250,000. Up to £50,000 of profits, the current corporation tax rate of 19% will continue, albeit labelled a small companies’ rate. In between those limits, the tax rate will be 19% on the first £50,000 of profits and 26.5% on the excess. This can mean that if you incorporate when your profits are modest, you may regret the move if your business starts to make more money.

How you draw income from your company will determine your overall tax bill. In the examples below, we have assumed:

- All of the profits will be drawn. This makes the picture consistent with the self-employed alternative under which all profits are taxed.

- You draw a salary of £8,840 a year from your company. At this level neither you nor your company will have any National Insurance Contributions (NICs) to pay.

- All your profit, after deducting your salary, is taxed at corporation tax rates and then paid to you as a dividend.

- The first £2,000 of your dividend is free of tax thanks to the dividend allowance, but still counts as part of your total income for tax purposes.

| SELF EMPLOYED | LTD CO 2021 | LTD CO 2023 | |

|---|---|---|---|

| Gross Profit | £75,000 | £75,000 | £75,000 |

| less salary | – | <£8,840> | <£8,840> |

| Taxable profit | £75,000 | £66,160 | £66,160 |

| less corporation tax | – | <£12,570> | <£13,782> |

| net profit = dividends | – | £53,590 | £52,378 |

| less National Insurance | <£4,316> | – | – |

| less Income Tax | <£17,432> | <£6,629> | <£6,235> |

| Net Income | £53,252 | £55,801 | £52,378 |

| Gain/loss if incorporated | +£2,549 | +£1,731 |

So, let’s consider the same scenario, but with larger numbers, double at revenue of £150,000…

| SELF EMPLOYED | LTD COMPANY 2021 | LTD COMPANY 2023 | |

|---|---|---|---|

| £ | £ | £ | |

| Gross Profit | £150,000 | £150,000 | £150,000 |

| Less Salary | – | £8,840 | £8,840 |

| Taxable Profit | £150,000 | £141,160 | £141,160 |

| Less Corporation Tax | – | <£26,820> | <£33,657> |

| Net Profit – dividends | – | £114,340 | £107,503 |

| Less National Insurance | <£5,816> | – | – |

| Less Income Tax | <£52,460> | <£30,616> | <£27,362> |

| Net Income | £91,724 | £92,564 | £88,981 |

| Gain/loss from incorporation | +£840 | -£2,743 |

The higher profit level highlights the impact of the corporation tax change: at £75,000 the corporation tax bill increases between 2021 and 2023 by 9.6%, but at £150,000 the bill jumps by 25.5%.

MORE IS MORE

If the corporation tax increase goes ahead – and there are voices suggesting it might be tweaked nearer the time – then on tax grounds the case for incorporation will be weakened, particularly at higher profit levels. However, as mentioned above, tax is not the only consideration.

ACTION

The numbers above are for two specific profit levels. Comparative calculations are complicated by the phasing out of the personal allowance, so there is no straight line between the £75,000 and £150,000 results.

The corporation tax move is another step on the slow path to rationalising the taxation of earnings between employees, the self-employed and owner directors. For a review of your personal situation and the tax saving opportunities available now, please talk to us.

For what its worth (nothing) if I were Chancellor, I’d have standard rates of tax irrespective of where the income is derived. This would make tax much more transparent, straight-forward and easier for everyone to understand. The problem lies in the will of Government.

Dominic Thomas

Solomons IFA

You can read more articles about Pensions, Wealth Management, Retirement, Investments, Financial Planning and Estate Planning on my blog which gets updated every week. If you would like to talk to me about your personal wealth planning and how we can make you stay wealthier for longer then please get in touch by calling 08000 736 273 or email info@solomonsifa.co.uk

GET IN TOUCH

Solomon’s Independent Financial Advisers

The Old Bakery, 2D Edna Road, Raynes Park, London, SW20 8BT

Email – info@solomonsifa.co.uk

Call – 020 8542 8084

GET IN TOUCH

Solomon’s Independent Financial Advisers

The Old Bakery, 2D Edna Road, Raynes Park, London, SW20 8BT

Email – info@solomonsifa.co.uk Call – 020 8542 8084