Howzat?

Howzat?

Howzat?

James Anderson recently became England’s most successful bowler as he took his as he took his 384th wicket, that belonging to Denesh Ramdin and overtaking Ian Botham in the process. This is of course an incredible achievement in International cricket – congratulations Mr Anderson. So I was surprised to see an item on the BBC sports website that attempted to work out who really was/is the best bowler England have ever had.

Sport as you will know has become increasingly dominated by statistics – attempts on target, completed passes, distance run, speed of delivery the list is very long and naturally varies from sport to sport. When winning any sport tournament, many rather dull teams/individuals have argued that its not the manner of the victory, just that there was a victory. I cannot help but think of the time Greece won the 2004 European Football championship (sorry Greece)… or for that matter many Champions League finals, where one team essentially set up camp in their own penalty area hoping to counter attack and steal a victory.

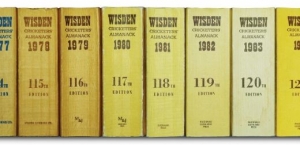

Cricket is not new to adopting statisitical analysis – arguably starting the statistical obsession with John Wisden’s annual almanac started in 1864. So anyone wishing to pour over cricket statistics has had plenty of opportunity to do so. Anyway the BBC asked its pundits to assess England’s top 10 bowlers and ascribe a value to the wicket taken. In short a batsman that averages 50 runs is worth more than one that averages 5. Recompiling the data provides a different twist with Matthew Hoggard topping the list (248 wickets). Whilst this is “all very interesting” sport, like life cannot be metered into a nice, neat formula. There is always a context, which even with a lengthy span of statistical data is flawed. For example – the quality of the opposition is a key ingredient, the prevailing rules, TV replays and so on, let alone the context of the pressure of the moment. Statistics are cold, unrepentent and have no context other than a time period.

Investment returns and the charts that you see plastered on advertising boards or in any media are similarly misleading. Most investors probably know that this is the case, but few behave as if it is. Most investors are tempted to invest once returns are good, most sell when they have been poor, on average chasing returns, receiving below-average market returns at above market cost. Sadly the equivalent best investment “gongs” or awards also measure historic data (there is no other) and the context of this is against peers. Who is the best fund manager? well it rather depends on which sector, what timeframe, what measure of risk is used, and what luck was involved. In short, its an impossible task, yet many play the game and attempt to quantify who is “best”.

In practice, the only investment returns that matter are the ones that you actually get. Cricket, motor racing, football, tennis, golf…are all enjoyable escapes, but again the only best that any sportsman/woman can be is their own best, in the context of their sport, time, team and luck. I have nothing against awards for best this or that, (they can be a lot of fun – especially if you win one or two) but as ever, context is everything. I can only be the best financial planner that I can be, constantly striving to improve and be better than I was last year, last month, last week… and of course our service (like most) is not for everyone, but for those that want and need it… well we try to make it the best possible.

Dominic Thomas