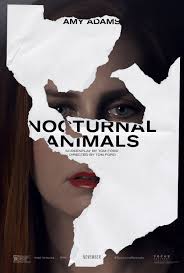

Nocturnal Animals, skin-deep values

Nocturnal Animals

The stories we tell ourselves invariably shape our lives. The choices we make about a partner, a spouse or a career are born of our own life experiences, encouragements and admonishments. In our culture, success, invariably translates as material wealth. Increasingly this is underlined by fame or notoriety, where maintaining an image is all. Nocturnal Animals explores these ideas.

Hungry

Traditionally within financial services, we have all been encouraged to want rather more. More will make us happier. To define our success by the amount of our net worth. When I began advising, over a quarter of a century ago, the mantra of the day by those leading and training new recruits was to encourage over-reach. To ensure that advisers were sufficiently motivated (hungry) to achieve sales. We were encouraged to appear successful, to be the success we wanted, despite not yet possessing any. Many took this as instruction to buy and acquire the things that presented the appearance of success, getting into debt in the process. This created further imperative to sell. The world of the adviser was very much “eat what you kill” which in short meant, if you don’t sell, you don’t eat. Almost everyone was self-employed.

Pressured Living

The result of a commission only culture, was unsurprising. “Advisers” were under huge pressure to make a living – which involved selling policies. This resulted in high-pressured sales and of course the bigger the commission the better. Anyone that genuinely wanted to advise clients fairly (by which I mean, not to rip off) was generally derided and ridiculed for their paltry earnings and stance.

Stand up, get out, shake up

Those advisers and firms that wanted a more ethical, sustainable approach had to choose to go against the grain, charging fees in a world of “free advice”. There were not many and it was only in 2013 that the regulation was put in place to make this the case, though it’s still half-baked now.

Predators and wild beasts

The stories we tell ourselves, to justify our actions are important and explored in the gripping, violent and intense drama of “Nocturnal Animals”. Exploring the base elemental instincts of desire, hunger and longing for success. Like animals on the prowl, laying traps for prey. The villain of the film, Ray Marcus, is utterly horrible and brought to life with a performance that will leave you sleepless by Aaron Taylor-Johnson.

Now you see me…

Today the entrapments are ever more subtle, though I’m sure Shakespeare and others would contend otherwise. Hiding a lie between two truths, disguising fact for fiction and vice versa (how Shakespearian right?). In the film, art dealer Susan (Amy Adams) is confronted with truths about her past that go some way to explaining her current malaise. The revelations are presented in a gripping, horrifying work of fiction. There are discomforting lessons for Susan and for us all. Who and what we choose to listen to and believe, has consequences, contrary to the narrative that implies otherwise.

Knowing not wanting

Whether you are a client, an adviser or just checking out our website, the key to knowing what we (all) really want and what we (all) value, requires understanding what and who we don’t want to be. As for Nocturnal Animals, it has both style and substance. As for the financial services industry, it still lives with the legacy of the past, as do many investors. Here is the trailer for Nocturnal Animals, an enthralling film by Tom Ford…

Dominic Thomas

Solomons IFA

You can read more articles about Pensions, Wealth Management, Retirement, Investments, Financial Planning and Estate Planning on my blog which gets updated every week. If you would like to talk to me about your personal wealth planning and how we can make you stay wealthier for longer then please get in touch by calling 08000 736 273 or email info@solomonsifa.co.uk