Arrival in Time

Arrival in Time

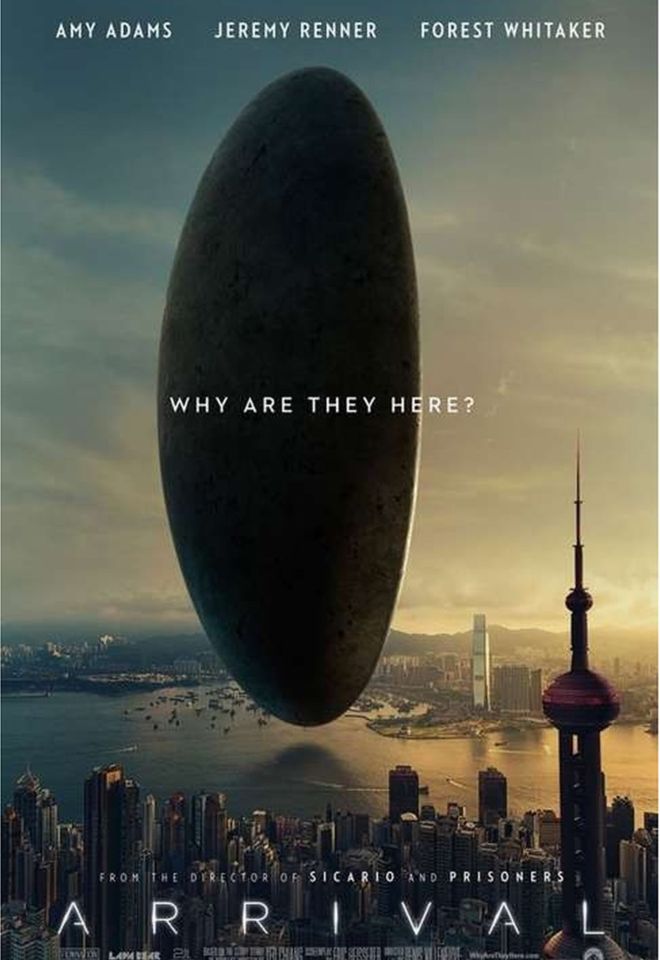

“There are days that define your story beyond your life, like the day they arrived”. Arrival, tells the story of an alien arrival (I’m not giving anything away). The film itself will likely get your grey matter working hard grappling with the concept of time. This is a very different alien movie, unlike any other that I have seen as it challenges the concept of time…well ok Interstellar did this too… and perhaps a little like the HG Wells story, but different in that it proposes time as non-linear.

Time as an image

As a financial planner, we use cashflow modelling in a very linear application. The present, perhaps a nod to the past, but a plan for the future. The result is translated into an illuminating image, which clients find very helpful indeed. Yet it is linear, which is of course it’s limitation. A great financial planning meeting will attempt to address questions about whether some of the plans in the future can be brought further forward, perhaps much more into the present. Never-the-less it is still a linear experience.

Life is a journey… and some

The movie Arrival is not really about aliens. It’s about communication and about being able to develop the adage “life is a journey, not a destination”. One that we play with in this site. Many people find financial services jargon to be fairly alienating. Communication is not something that our sector has done terribly well in the past. The film seems to ask the question whether we would change the image, if our life was reduced to a single image, with all its joys, but with all its pains. One might argue that there is something almost deity-like in this understanding of time and it is rather different from our more linear rational explanation. This might be viewed by the fairly expected traditional male approach of binary thinking, as often displayed in our world, with the “if you aren’t for us, you must be against us” rationale. This is given character in the usual full military display and response to anything different or other worldly. It takes a female linguist (Louise, played by Amy Adams) to have the humility and wisdom to listen and comprehend the message provided by the Heptapods.

Lessons from Arrival

Financial planning looks at the future and adjusts the present to have a better chance of reaching the one you want. Arrival, is more accepting of what is, when it was, is or will be, but all at the same time. Time is not linear. So, from a financial planning perspective, the movie doesn’t teach us a lot other than to remind us to listen to what is being communicated and attempting to avoid the binary choice mentality that is rarely constructive. However, the idea of being able to visualise and create an image of your life for you to see, well that’s very much an aspect of proper cashflow modelling, which is all about conveying your choices about the future visually.

If you haven’t seen it yet, here is the trailer for Arrival. I enjoyed it a lot.

Dominic Thomas

Solomons IFA

You can read more articles about Pensions, Wealth Management, Retirement, Investments, Financial Planning and Estate Planning on my blog which gets updated every week. If you would like to talk to me about your personal wealth planning and how we can make you stay wealthier for longer then please get in touch by calling 08000 736 273 or email info@solomonsifa.co.uk