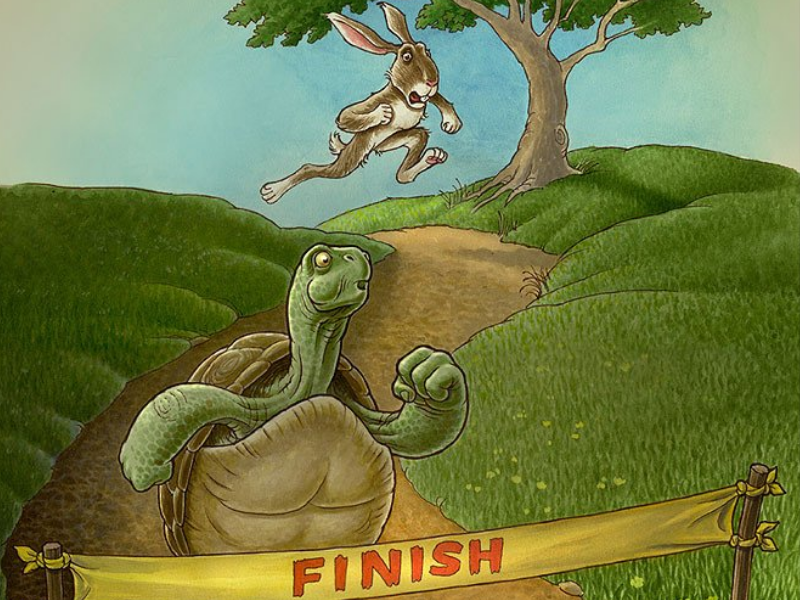

SLOW AND STEADY…

TODAY’S BLOG

You would think (given that I work for a financial planning firm!) that I would be great at handling my finances. Unfortunately, this is not something I have totally figured out…

I am a 20-something woman, living in and galivanting around London. I like to keep myself busy with events and activities – I love the buzz and vitality of ‘city life’. Whilst I am thoroughly enjoying my time and having some fabulous experiences, I also know that I need to say no sometimes to try and save for my future endeavours … right?

“YOU’RE YOUNG; YOU HAVE SO MUCH TIME; JUST ENJOY IT”

I am constantly torn between living ‘in the moment’, enjoying London whilst I’m here, and also saving for my future lifestyle (my needs and dreams are sure to alter as I get older). I am frequently reminded by anyone remotely older than me, that I am ‘’SO YOUNG, you can do anything, you have no real responsibilities!” – which to me sounds like code for – you have no children or a mortgage so HAVE ALL THE FUN. Which on the one hand makes a great deal of sense, but it’s hard to ignore the fact that living in the moment is all well in good, but thinking about my future is something I mustn’t avoid. Whilst I enjoy hearing from others that I am in a period of my life where being young and free needs to be enjoyed, I still often hear people reflecting saying they wished they’d saved more when they were younger or they wished they had done xyz as well. Hindsight is 20/20 vision of course.

In the last few years, I have started to see friends of roughly my age buying their first home, getting engaged or having children. Whilst of course this is all a matter of perspective based on our individual choices, circumstances, income etc; I can’t help but feel I am now in a hurry to get on and do everything, as well as ‘save’ for ‘future me’. I am told that I have all the time in the world, and yet I feel like I am starting to run out of it at the same time!

MY WISE OLD MANAGER …

As I was beginning to feel slightly overwhelmed trying to compartmentalise my financial life whilst enjoying life in the city, my lovely manager Debbie brilliantly guided me to a realisation that saving little by little was possible, and that I needn’t worry about saving huge chunks (I was never able to save huge chunks, but little chunks didn’t seem to be enough in my mind!). She told me that every evening after having whatever fun I was having, I should move money into my savings account so that each night my account balance was left at a round number. I remember laughing and saying that this would make no difference – moving 50p here, £3.80 there … what a long-winded approach! And yet … she was completely right. Soon after starting to do this, I realised that each month I was actually saving! And I was also made to be more mindful at the same time. It didn’t hurt or stop me going out, it was done so subtly that it was easily doable.

It’s taken some time, and I still have moments of forgetting and missing a few days, but I feel I am finally at a place where I can feel comfortable and confident about putting away ‘a little something’.

And already in the new year, I’ve managed to keep saving. Admittedly it’s not a lot – but it’s a start, and I’m proud of what I’ve managed to achieve. It’s a reminder that it doesn’t matter how much it is, slowly I am beginning to create a little pot of gold for my future.

And in much the same way, it is incredibly satisfying for us to see the differences for our clients (which can be phenomenal) that a planned approach (even if ’slow but small’) can bring about … ultimately enabling choice and financial freedom.

Jemima Thomas

Solomons IFA

You can read more articles about Pensions, Wealth Management, Retirement, Investments, Financial Planning and Estate Planning on our blog which gets updated every week. If you would like to talk to us about your personal wealth planning and how we can make you stay wealthier for longer then please get in touch by calling 08000 736 273 or email info@solomonsifa.co.uk

GET IN TOUCH

Solomon’s Independent Financial Advisers

The Old Bakery, 2D Edna Road, Raynes Park, London, SW20 8BT

Email – info@solomonsifa.co.uk

Call – 020 8542 8084

GET IN TOUCH

Solomon’s Independent Financial Advisers

The Old Bakery, 2D Edna Road, Raynes Park, London, SW20 8BT

Email – info@solomonsifa.co.uk Call – 020 8542 8084