970 BOTTLES OF BEER ON THE WALL

TODAY’S BLOG

970 BOTTLES OF BEER ON THE WALL…

I’ve been trying to think of ways to explain the benefit of long-term investing. I’m not a big beer drinker, but given that when I do go to a pub, I’m always shocked at how much a pint of beer is. According to the ONS, the average pint of beer in the UK was £3.67 in January this year. Clearly a national average, because that wouldn’t buy much in London.

30 Years Ago… 1989

Anyway, let’s suppose I am someone that likes to buy the occasional pint of beer. As I get older, like most people I tend to remember elements of the past fondly. Particularly this time of year as students return to University. 30 years ago, perhaps you were at University or had long since left. 1989 – the time when Nigel Lawson was replaced as Chancellor by John Major. Simply Red had a hit album “A New Flame”; Challenge Anneka had aired for the first time and Nick Faldo won the Open. A pint of beer back then was £1.03.

YOUR ANXIETY

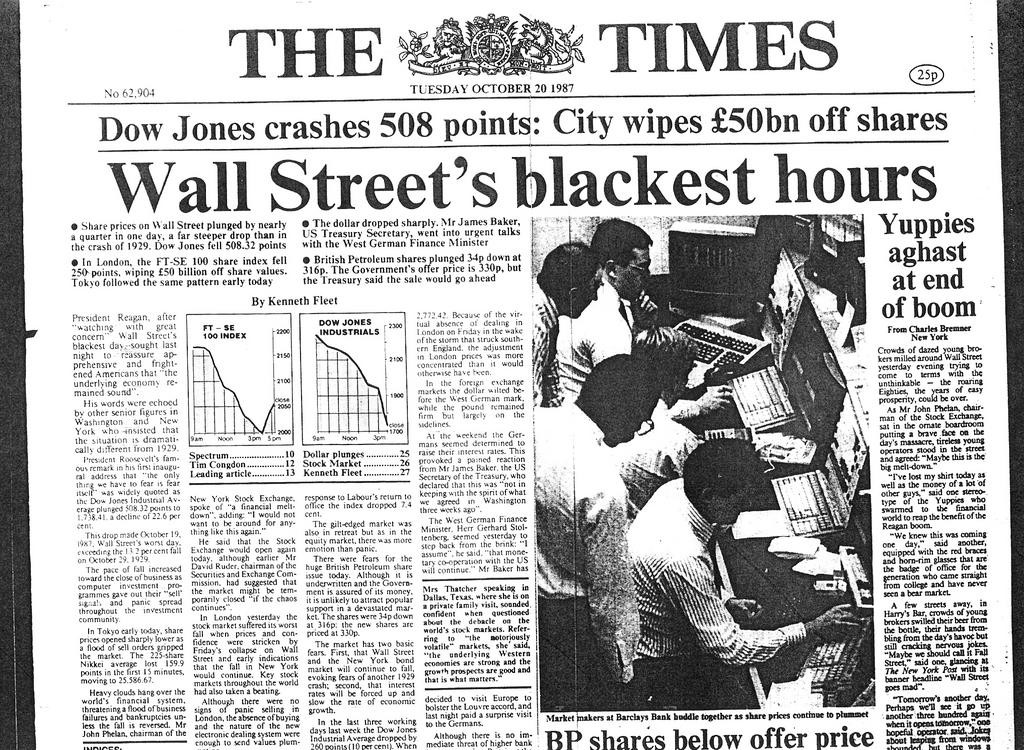

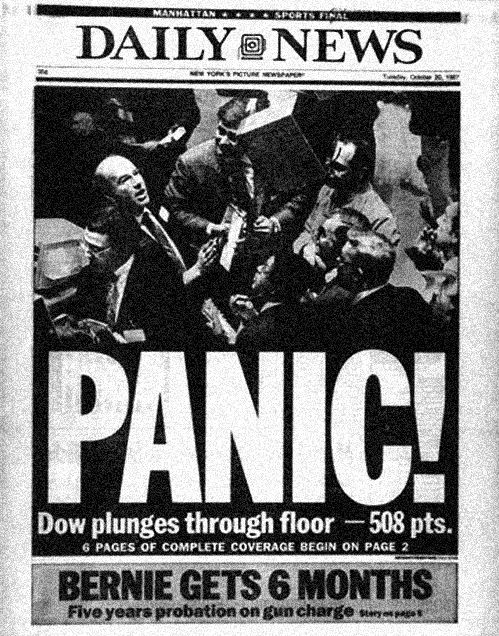

Let’s suppose you had £1000 you wanted to do something with. The memory of Michael Fish and the great storm closely followed by Black Monday was fairly fresh in your memory. You didn’t fancy the stock market. So you found a decent deposit account, rates were high causing problems for borrowers but great for savers at 14%.

Thirty years later that £1000 had risen to £2,080 by January this year. You had forgotten about it except for when you sighed with relief as economic recessions came, Y2K, Dotcom bubble, Korean crisis, 9/11, credit crunch – you had avoided them all.

Yet there is a problem. In 1989 your £1000 would have bought a 30-year younger you 970 pints of beer. Today your £2,080 would only stretch to 566 pints.

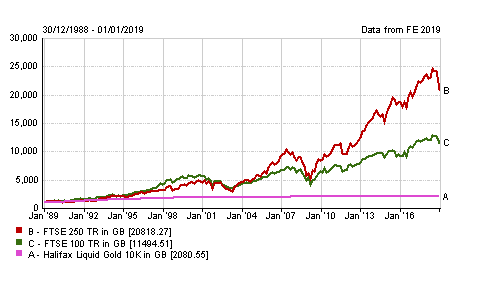

Your Uni Friend John had a PEP

Your good friend John from University had put his money into the UK stock market, he put £1,000 into a Personal Equity Plan, some quirky idea brought in by Nigel Lawson. He bought a FTSE100 tracker fund (ok, maybe not, but stay with me). He had to live with the same economic stresses and saw the topsy turvy workings of the stock market. However, at the end of 30 years his £1000 was worth £11,494. He hadn’t touched it (neither had his adviser) and so all dividends were reinvested. This sort of money enables John to buy 3,131 pints of beer. That’s 5 times more than your 556 pints.

Julia also had a PEP

John is fairly happy, but his girlfriend Julia at the time also put £1,000 into a PEP, but she put it all into the FTSE250 tracker. She figured that slightly smaller companies might do a bit better than bigger ones. Lo and behold, Julia’s £1,000 has turned into £20,818. Julia can buy 5,672 pints of beer, that’s ten times (10x) TEN TIMES as much as your 556 pints.

OK – Smallprint (or not) Caveat Emptor…

Admittedly I have taken some liberties with costs, charges and the available funds in 1989. The biggest liberty I really took was suggesting that people leave their money alone. They/we don’t. We all tend to fiddle around, attempting to find a slightly or perhaps considerably “better” option.

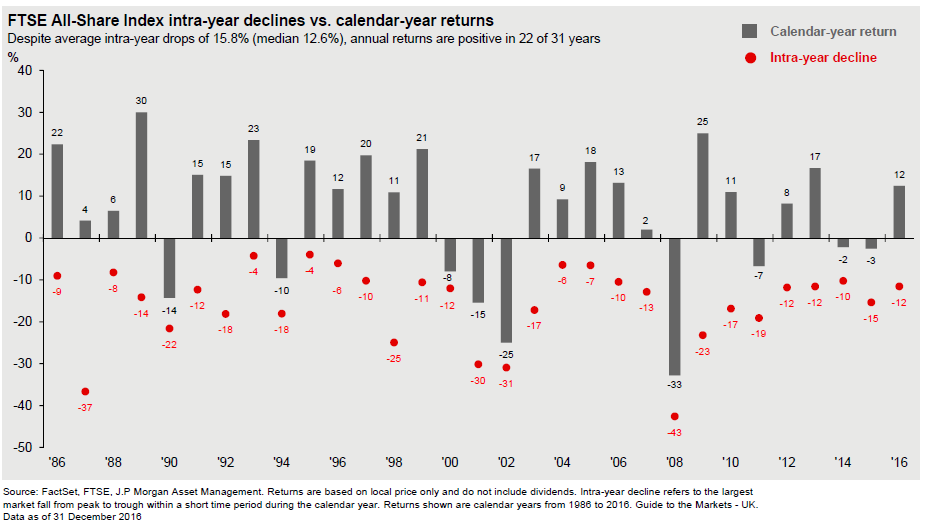

Long story short, when considering investment for decades, what on earth does “risk” really mean? The risk of the power of the money in your pocket being worth less (or worthless) due to rising prices? The risk of seeing your money stagnate in cash? The risk of seeing the value of investments rise then fall?

Monsters grow

What ought to be blindingly clear…. don’t let your anxiety dictate your financial planning and investment strategy. It is a dreadful guide to future performance. The monster at your door is inflation, however small it seems today, feed it for 30 years and it’s still hungry and likely to eat you alive.

Dominic Thomas

Solomons IFA

You can read more articles about Pensions, Wealth Management, Retirement, Investments, Financial Planning and Estate Planning on my blog which gets updated every week. If you would like to talk to me about your personal wealth planning and how we can make you stay wealthier for longer then please get in touch by calling 08000 736 273 or email info@solomonsifa.co.uk

GET IN TOUCH

Solomon’s Independent Financial Advisers

The Old Bakery, 2D Edna Road, Raynes Park, London, SW20 8BT

Email – info@solomonsifa.co.uk

Call – 020 8542 8084

GET IN TOUCH

Solomon’s Independent Financial Advisers

The Old Bakery, 2D Edna Road, Raynes Park, London, SW20 8BT

Email – info@solomonsifa.co.uk Call – 020 8542 8084