Pension Scams – The Empty Box

Pension Scams – The Empty Box

Yesterday I outlined that 2015 has been a poor year for investors. I also pointed to not making a bad situation worse by making further mistakes. Invariably and sadly, many are tempted by high returns elsewhere in an effort to recoup losses and/or an unwillingness to accept the reality of life.

Unfortunately, there is always a willing con-man to part you from your money with promises that tempt some to make some dreadful decisions. The BBC radio 4 programme “You and Yours” which can be found on the iplayer which aired 2 weeks ago (3rd December) is worth listening to. It’s a 45 minute show, so put it on whilst you are wrapping gifts for Christmas. You can find it here. (click)

This story has been around for a while, the regulator warned about it some time ago. In a nutshell, this is the story of pension liberation, though I don’t think the term is used anywhere (it ought to be). The brief version is that investors were encouraged to move their pensions into a SIPP (Self Invested Personal Pension) and once there, the money was invested into a “fund” which is unregulated. The fund was actually a “dead cert” of an investment, which was actually storage units or “storage pods” with Store First. One might hope that most people would think at least twice before making such an “off the page” investment, but it doesn’t help when a well-known person from the media appears in the commercial suggesting the implausible is possible… in fact guaranteed.

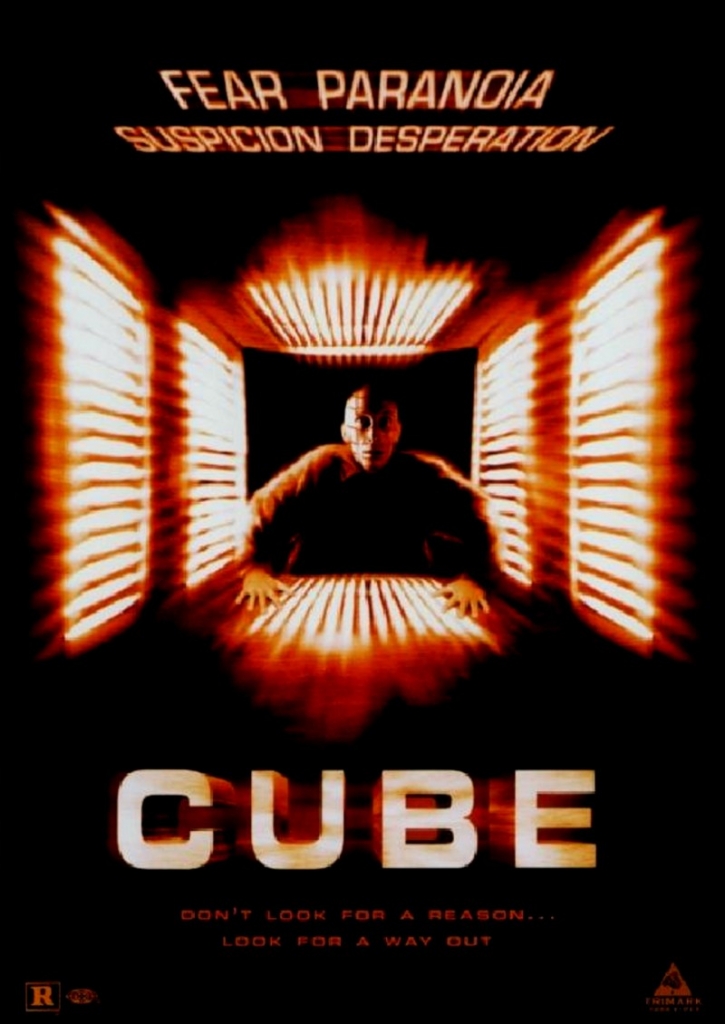

The Empty Box

Recap: the investment actually went buying a storage unit, then hoping that it will be rented and that the pod will appreciate in value. The price of the pod does not appear to be a market rate and attempting to sell the pod at anything like the purchase price is… well something about snowballs and hell freezing over. Note there are many similar “opportunities” arriving to your spam mailbox.

Let me be clear, there is nothing wrong with anyone renting or offering to rent or run a business that rents storage space. However as a direct investment, you are essentially becoming a business that rents storage space, so do you have all the facts to hand? and even if that is the case, of all the business opportunities “out there” do you really want to rent a box to others for profit? How much of such a business strategy is actually within your control?

There are lots of problems with what happened, for starters the advisers were not authorised (qualified, vetted, approved and regulated) advisers and they breached all sorts of regulatory standards. The processes involved were corrupted and frankly anyone doing even a modicum of research would probably conclude that this is not typical investing.

Unfortunately as the “fund” is unregulated, there is no compensation, despite appearing within a pension.

Tomorrow I will conclude by outlining some of the facts and part-truths from the Radio 4 programme, so that you don’t fall victim to something similar.

Dominic Thomas

Solomons IFA

You can read more articles about Pensions, Wealth Management, Retirement, Investments, Financial Planning and Estate Planning on my blog which gets updated every week. If you would like to talk to me about your personal wealth planning and how we can make you stay wealthier for longer then please get in touch by calling 08000 736 273 or email info@solomonsifa.co.uk