£50 Note – A Collectors Item?

£50 Note – A Collectors Item?

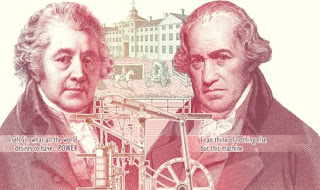

The new £50 Matthew Boulton and James Watt banknote should come into circulation today. It celebrates two British entrepreneurs and their partnership, that makes the Dragons Den look like amateurs. This is the first time that two portraits have appeared together on a British bank-note, so perhaps the £50 will be a collector’s item… as if we needed encouragement! This new £50 has added security features (though we have not yet reached the point where it requests owner ID information or a retinal scan). Gradually the new note will replace the existing John Houblon note, which will eventually become defunct.

Dominic Thomas

Solomons IFA

You can read more articles about Pensions, Wealth Management, Retirement, Investments, Financial Planning and Estate Planning on my blog which gets updated every week. If you would like to talk to me about your personal wealth planning and how we can make you stay wealthier for longer then please get in touch by calling 08000 736 273 or email info@solomonsifa.co.uk