Talking Money…. again

Talking Money… again

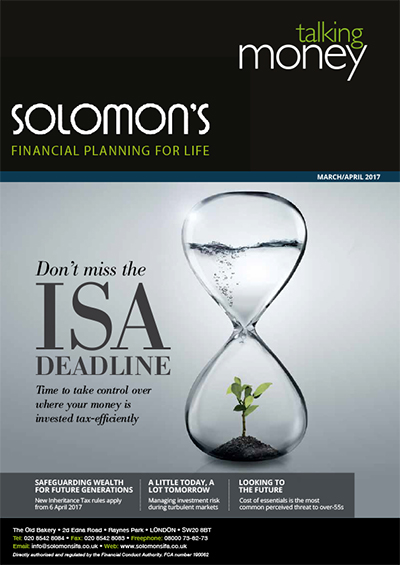

As you will have gathered from the plethora of adverts in the weekend papers and advertising hoardings everywhere, the tax year is coming to a close. This means it is your last chance to use up your 2016/17 ISA allowance of £15,240 or perhaps a Junior ISA for those young enough.

This tax year has had many unwelcome changes, most significantly the pension tapered annual allowance, which has reduced the annual allowance (normally capped at £40,000) to a £10,000. This applies to anyone with “adjusted income” over £150,000. But that doesn’t make you “safe” if you don’ earn £150,000. As the annual allowance is £40,000, the maths starts at £110,000 of income. Pension contributions paid are added to income, indeed any income, be it rent, dividends or interest are all counted. So many may well find that they have exceeded the annual allowance.

Deliberate Complexity

Yes, the Government could have made things easier, but why bother when there are so many willing voters who will forget the hassle at the ballot box. In fact, Mr Hammond, the Chancellor has had two opportunities to abolish this utterly ludicrous rule in either in his Autumn Statement or his Budget last week. There are tax penalties and charges if this is exceeded and you don’t have any unused relief from any of the three previous tax years 2015/16, 2014/15 and 2013/14. Pensions have the ability to go back 3 tax years if you exceed your annual allowance.

Shrinking heads?

To provide a little more context – ten years ago, the annual allowance was £215,000 in 2006/17, it rose each tax year to £255,000 by 2010/11. It was then slashed to £50,000 for 2011/12 and remained at that level until 2014/15 when it became £40,000. Today in 2016/17 it is likely to be £10,000 for many high earners.

Of course the Government knows what they are doing, by encouraging us all to save for our retirement and financial independence…. I expect that we will soon hear “lessons will be learned”. Oh and no, this is not fake news, its just unwelcome news.

Clients will be receiving a printed copy of Talking money this week, which has some more facts.

Dominic Thomas

Solomons IFA

You can read more articles about Pensions, Wealth Management, Retirement, Investments, Financial Planning and Estate Planning on my blog which gets updated every week. If you would like to talk to me about your personal wealth planning and how we can make you stay wealthier for longer then please get in touch by calling 08000 736 273 or email info@solomonsifa.co.uk