Tracker/Index funds

Sam Harris

May 2025 • 2 min read

Tracker/Index funds

You may have heard the terms ‘Tracker’ and ‘Index’ thrown around when we talk about investments or your portfolio, but what do these terms mean and what are the key features?

Simply put, a tracker portfolio aims to mimic the performance of global markets. This is typically done through index funds. An index in the context of stock markets is essentially just a list of companies. Though, there are often certain criteria a company must satisfy in order to be included, such as market capitalisation (the value of the company).

I’m sure you’re already familiar with well-known indices such as the FTSE 100, which is an index made up of the 100 largest British publicly traded companies. Or even the S&P 500 which is comprised of the 500 largest American companies. These funds ‘track’ the UK stock market and the American stock markets respectively.

Index tracking funds come with the added benefit of generally being less expensive than most alternatives. This is due to the passive nature of this type of investment, these funds are simply trying to replicate an index so most of the hard work has already been done by another organisation. For example, Vanguard might offer an equity fund which tracks the FTSE 100 index, however the index itself is calculated and maintained by FTSE Russell.

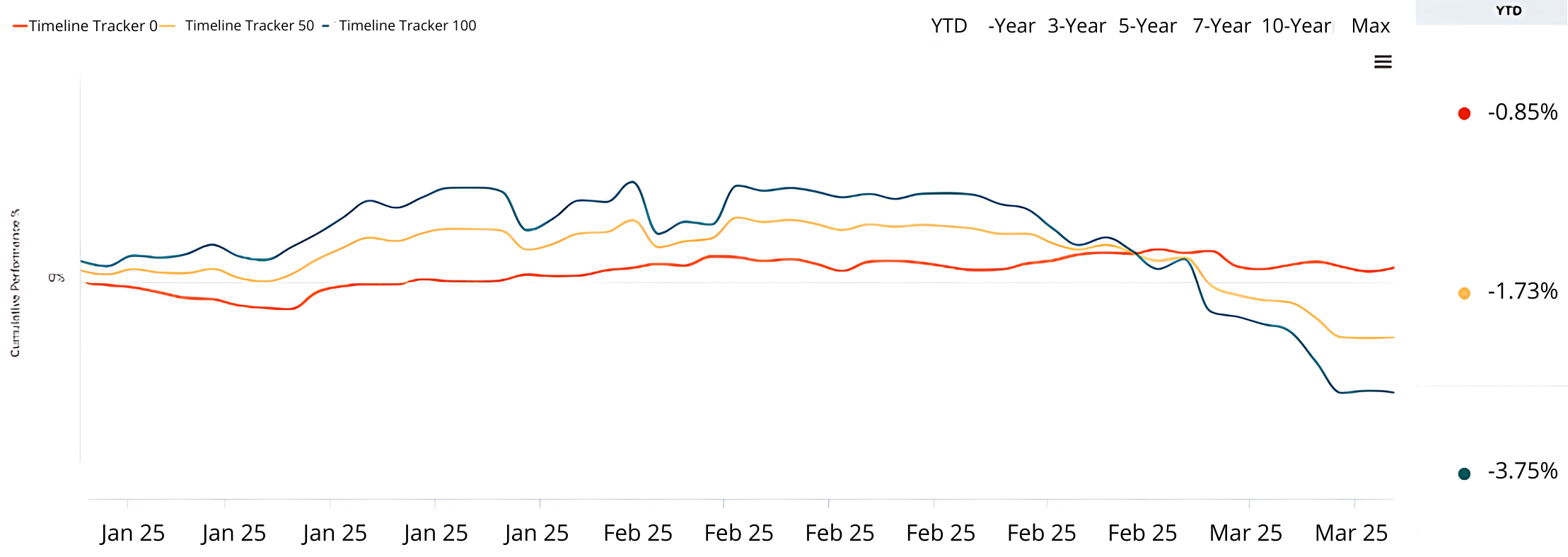

The Tracker portfolios we use at Solomon’s are prime examples of utilising index funds to ensure investments are well diversified. Meaning, that the markets which are performing well help mitigate losses from markets which are struggling. Conversely, this could also be seen as underperforming markets eating into the gains of strong markets. Though ultimately, diversification is a strategy used to reduce risk, rather than to increase returns. The aim is not to beat the global markets, but rather to match them.