Planning for your estate to pass to your beneficiaries, reducing inheritance tax

Estates: Your Will online forever

Estates: Your Will online forever

You may not be aware that the Government has now made it possible to search for Wills online. So once you are gone, your last Will and testament is available for anyone to see, should they wish to. Essentially it is nothing more than a searchable database which enables anyone to pay £10 to obtain an electronic copy of historic Wills, assuming the system works, you will receive your copy within about 10 days. It is free to search, but the Will itself costs £10.

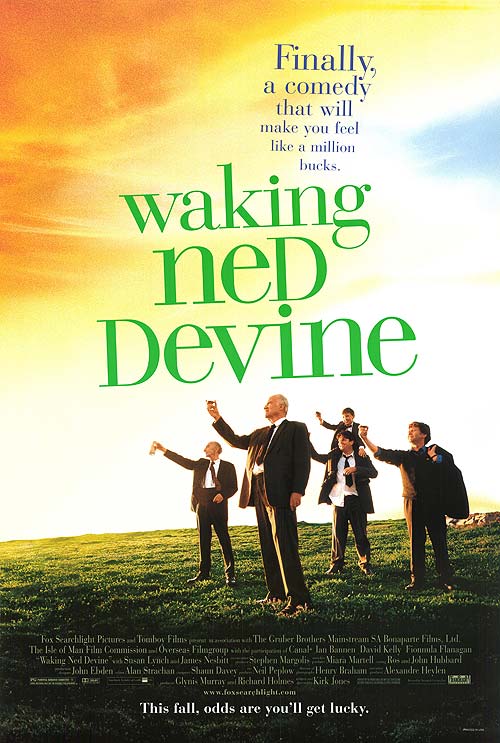

It is estimated that there are over 41 million Wills and Grants of Probate on the database, which are compiled from 1858 onwards for England and Wales. I’m reminded of the film “Waking Ned Devine” which is a comedy about a man who wins the lottery but dies from shock, to collect his winnings, he has to be alive, leaving his community to concoct some creative solutions.

Implications

There will be some people who certainly won’t relish the prospect of their Will being published online – perhaps a few celebrities or even Royalty. Remember that for some people a Will reveals the state of family relationships at the point the Will was made.

HMRC better informed?

Perhaps the more important point about a Will or Grant of Probate is that assets are valued and those that are inherited ought to be more visible. This essentially provides a money trail for HMRC to follow. Remember evading tax is illegal, but with this approach it really ought to be the case that HMRC are able to now close in on those that don’t declare sufficient assets in their estate.

There are also implications for capital gains tax too – if you inherit an asset, then unless you sell it, or gift it, there is reasonable grounds to assume that you still own it. If it disappears from your asset inventory, surely questions would be asked which have a knock on effect for prospect of unpaid capital gains tax and perhaps even income tax (if the asset generated income). In short, anyone that isn’t being crystal clear about their assets is likely to come under greater scrutiny.

Other implications also revolve around more “joined up thinking” in that your DVLA licence and car insurance are connected and if you now try to rent or hire a car, you need to input your NI number so that a DVLA permission certificate can be generated. This could be used to link to your investments (pensions and ISAs in particular) but why not your household insurance policy, meant to insure your physical assets.

All in all, I think this will lead to deeper and better information about us all, which will to some extent be publicly available, but more importantly available to HMRC. So make sure you declare your assets and taxes properly. Above all make sure your Will is current and reflects your wishes.

Dominic Thomas

Solomons IFA

You can read more articles about Pensions, Wealth Management, Retirement, Investments, Financial Planning and Estate Planning on my blog which gets updated every week. If you would like to talk to me about your personal wealth planning and how we can make you stay wealthier for longer then please get in touch by calling 08000 736 273 or email info@solomonsifa.co.uk