Waiting for Certainty?

Waiting for Certainty?

A frequent complaint from would-be investors is that “uncertainty” is what keeps them out of the financial markets. “I’ll stay in cash until the direction becomes clearer,” they will say. So when has there ever been total clarity? Alternatively, people who are already in the market after a strong rally, as we have seen in recent years, nervously eye media commentary about possible pullbacks and say “maybe now is a good time to move to the sidelines”. While these kneejerk, emotion-driven swings in asset allocation based on market and media commentary are understandable, they are also unnecessary. Strategic rebalancing provides a solution, which we will explain more of in a moment.

But first, think back to March, 2009. With equity markets deep into an 18-month bear phase, the Associated Press provided its readers with five signs the stock market had bottomed out and followed that up with five signs that it hadn’t.1 The case for a turn was convincing. Volumes were up, the slide in the US economy appeared to be slowing, banks were returning to profitability, commodity prices had bounced and many retail investors had capitulated and gone to cash.

But there also was a case for more pain. Toxic assets still weighed on banks’ balance sheets, economic signals were patchy, short-covering was driving rallies, the Madoff scandal had knocked confidence and fear was still widespread. Of course, with the benefit of hindsight, that month did mark the bottom of the bear market. In the intervening period of just over five years, major equity indices have rebounded to all-time or multi-year highs.

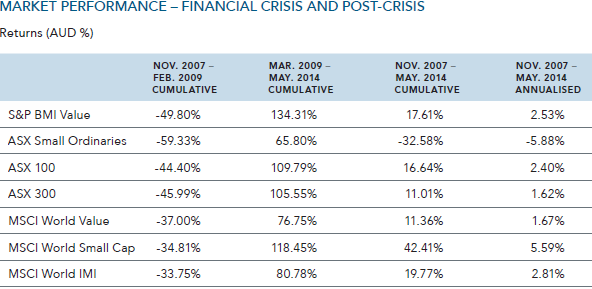

This table below shows the cumulative performance of major indices in the 18 months or so of the bear market from November, 2007 and then the cumulative performance in the subsequent five-year recovery period. You can see there have been substantial gains across the board since the market bottom. And while annualised performance over the six-and-half years from November 2007 is not impressive, the pain has been a lot less for those who did not bail out in March, 2009.

So those who got out of the market at the peak of the crisis and waited for “certainty” have realised substantial losses. But keep in mind, also, that these past five years of recovery in equity markets have also been marked by periods of major uncertainty.

In 2011, Europe was gripped by a sovereign debt crisis. Across the Atlantic, Washington was hit by periodic brinksmanship over the US debt ceiling. In Asia, China grappled with the transition from export-led to domestic-driven growth. Around any of these events, there were a broad range of views about likely outcomes and how these possible scenarios might impact on financial markets. The big question for the rest of us is what to do with all this commentary.

The fact is even the professionals struggle to consistently add value using analysis of macro-economic events, as we see repeatedly in surveys of fund-versus-index returns. And history suggests that those looking for “certainty” around such events before investing could set themselves up for a long wait.

There is always something to fret about. Recently, the focus has been on low volatility, particularly when compared to the days of 2008-09. Sage articles muse over whether risk is being appropriately priced and whether volatility is being unnaturally suppressed by central banks’ explicit forward guidance about policy.2 Just as in March 2009, one does not have to look far to find well-reasoned discussion in support of why the market has topped out, alongside equally compelling reasons of why the rally might continue for some time.

What is the average investor supposed to make of all this conjecture? One way is to debate the market implications of news and to try to anticipate what might happen next. But whom do you believe? We’ve seen there are always cogent-sounding arguments for multiple scenarios.

An alternative approach is much simpler. It begins by accepting the market price as a fair reflection of the collective opinions of millions of market participants. So rather than betting against the market, you work with the market.

That means building a diversified portfolio around the known dimensions of expected return according to your own needs and risk appetite, not according to the opinions of media and market pundits about what happens next month or next week.

It also means staying disciplined within that chosen asset allocation and regularly rebalancing your portfolio. Under this approach, you sell shares after a solid run-up in the market. But the trigger for this rebalancing is not media speculation, but the need to retain your desired asset allocation.

Say you have chosen an allocation of 60% of your portfolio in equities and 40% in fixed income. A year goes by and your equity allocation has rallied strongly so that the balance between the two has shifted to 70-30. In this case, it makes absolute sense to take some money out of shares and move it to bonds or cash.

It works the other way, too, so that if shares have fallen in relation to bonds, you can take some money out of fixed income cash and buy shares. Essentially this means buying low and selling high. But you are doing so based on your own needs rather than on what the armies of pundits say will happen in the market next. Of course, this doesn’t mean you can’t take an interest in global events. But it does spare you from basing your long-term investment strategy on the illusion that somewhere, at some time, “certainty” will return.

Jim Parker: Dimensional

________________________________________

1. ‘Five Signs the Stock Market Has Bottomed Out and Five Signs It Hasn’t’, Associated Press, March 15, 2009

2. ‘When Moderation is No Virtue’, The Economist, May 22, 2009