What is the best way to save for retirement?

As pretty much everyone is now being told to open a pension under the new auto enrolment rules, perhaps it is appropriate to cover the basics of what pensions are what some of the alternatives (or additions) that are also available. I’m going to provide a basic course on pensions, annuities and the alternatives. Bite size chunks that we can all manage.

Pension Plan Basics

Let’s start with some basics. A pension is not a pension. A pension is little more than a savings plan or pot with tax relief (a Government sweetener). The income that you ultimately take is really your pension, however to confuse matters this is invariably called an annuity. Yes, if it wasn’t true, you’d think that the financial services industry simply made it up to keep you in the dark.

Cut to the chase

In the hope of not boring you to death, I’m going to start at the end. Let’s say you have now decided to retire. If you have a pension (and there are lots of types based on history) they tend to fall into one of two camps, firstly a final salary (sometimes call defined benefit) pension and secondly a “Money Purchase” pension (or in plain English an investment based pension). In this post I’m only going to refer to the latter (an investment based pension).

A pension fund is a pot of money

So you are now at retirement and have a pot of money. You have loads of choices. You can take 25% of the fund as tax free cash and put it straight into your bank account and go spending. The balance (or all of it) is normally used to buy an annuity. This is simply an income for life. The income will stop when you die unless you have a spouse and you have included an option to have the income continue to him/her after your death for the remainder of their life. Simple enough right? Well yes and no. Simple idea, tough decisions. Why? Because you have to take a gamble on what you think the rate of inflation will be for the remainder of your life – do you buy an annuity that rises each year at RPI or an agreed amount (say 3% each year) or do you have a higher initial income but that stays constant. As a guide it will take about 12 years for a rising annuity to catch up with a level one and another 12 years to have paid out more in total. So as well as having to predict inflation (which by the way economists, Bank of England, Chancellor, professional investors) all fail to get right) you also have to guesstimate how long you will live.

Are we there yet?

Oh and if you think, “not long” remember that the average age of death for a man is now about 80 and about 84 for a woman… but then consider your own family’s longevity and perhaps add a bit for improved diet, lifestyle and medical care… unless of course you are wolfing down the processed food whilst spending no time outside getting any exercise. Alternatively like about 40% of people at retirement age, you may be taking regular medication for high blood pressure etc, in which case you probably qualify for an enhanced annuity. This is a polite way of saying “you have a reduced life expectancy”.

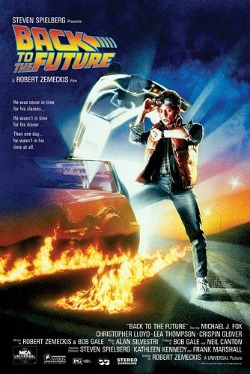

Back to the future..

So – a pension is not a pension, an annuity is a pension. You have to take a gamble on what inflation will do and how long you will live. You may want to build in a spouses pension, if not the annuity will die with you. To make the decision a little more pressured, once you have gone down this route, there is no U-Turn, no change of mind. You have to live with it. Sadly there is no time machine to see the future. Steve Webb, the pensions minister doesn’t like this either… but there are no easy solutions, unless you have a DeLorean with a Flux Capacitor.

Next up…what are your other options to buying an annuity? I will cover that tomorrow.

Dominic Thomas: Solomons IFA