You will not have been able to avoid the news about the US Government being paralysed by the bureaucracy of democracy and resulting in the US Government shut down. The rights and wrongs of this are not for me to debate, essentially the matter boils down to ideology and whether you believe that Government is a good thing or not. We all know that Governments can be tiresome with their constant squabbling and policy changes, however, I would rather have one that at least attempts to manage our national common interests, than leave things to resolve themselves. This is of course a hugely hot political topic and not my arena of expertise.

$16 trillion and rising

In essence the US Government cannot pay its way. As with the majority of Governments around the world it has only two main options to finance its plans – to tax and to borrow. A third approach is to sell (privatization). The problem being that the level of borrowing has soared over the decades and taxes have remained relatively low. The total Federal debt is now roughly $16,738,158,460,000 and rising. Unlike an individual, the Government inherits the collective debt and is therefore fairly constrained in what it can do. Of course, it isn’t only debt that is inherited, but the infrastructure, policies, economic and political scenario at the time. To say that each Government is not left with much “wriggle room” is an understatement and probably reveals why there is relatively little practical difference between mainstream political parties.

Care required…interpreting the data

So in this context, when the Tea Party who in general oppose Government and taxes attempt to seize the opportunity to reverse major spending plans; in this instance, spending on healthcare or “Obamacare”. Unlike here in the UK, you cannot pitch up at hospital and expect or rather demand medical treatment; you can only do so in the US if you have insurance, which as you may gather is pretty expensive. I know where I would rather live. However, in reality this is one issue – the US debt has risen for many reasons, the bank bailouts, wars and a population of over 300m. Any blame or interpretation of a “chart” needs to be considered carefully.

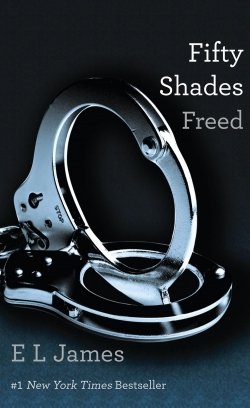

Fifty Shades? the real bondage is debt

Anyway, long story short. The US is at a stalemate. It might default on its debt payments, which would mean that its own borrowing costs would rise (just like you and I would experience). This wouldn’t be the end of the world, but it is not healthy. Indeed it rather proves the proverb that a borrower is the slave to the lender. The more debt you have the less wriggle room you have and therefore the more compromise you are likely to have to make, which invariably makes for considerable discomfort. This is why I focus on clearing debt first. Stockmarkets rise and fall, but debt left to market conditions, tends to become out of control.

Dominic Thomas: Solomons IFA