I have plenty of time to sort out auto enrolment right?

I have plenty of time to sort out auto enrolment right?

I have plenty of time to sort out auto enrolment right?

Love it or loathe it, auto enrolment is under way. The biggest companies and organisations are now running their schemes. As an employer you may be thinking that you have plenty of time to sort out your auto enrolment, you don’t. On the face of it one would think that setting up a pension for everyone to be opted in from the outset would be straight-forward (if I were King…) however there are all manner of obstacles to overcome, many of which employers are not terribly aware of. The truth is that this is not really about pensions, but about compliance and communication. Whilst the process is dressed as a pension, the reality is that the pension bit is probably the easiest element to resolve.

The real issue is to ensure you are compliant with the rules. This means not being late for your date, that is your staging date (find it here). If you are a small firm with 4 or fewer staff the fixed penalty is £400 and then £50 a day. If you have 5 staff its £500 a day, rising to £10,000 a day for firms with 500 or more staff. So it simply isn’t worth being late and in practice the entire process is likely to take 12 months from start to “implementation” and rather like having a baby, the pregnancy and then birth is not the end of the job… its an ongoing process, requiring a lot of time, effort and understanding.

So in preparation (the pregnancy part) quite a lot needs doing, this is where a financial adviser can help, though many employers will hope that they don’t need assistance, they probably will. In this analogy (and I don’t want to stretch it too far) the financial adviser is rather like the local GP, who is involved with the care, monitoring and progress and the life-long after care, but the parents (the employer) carry the responsibility.

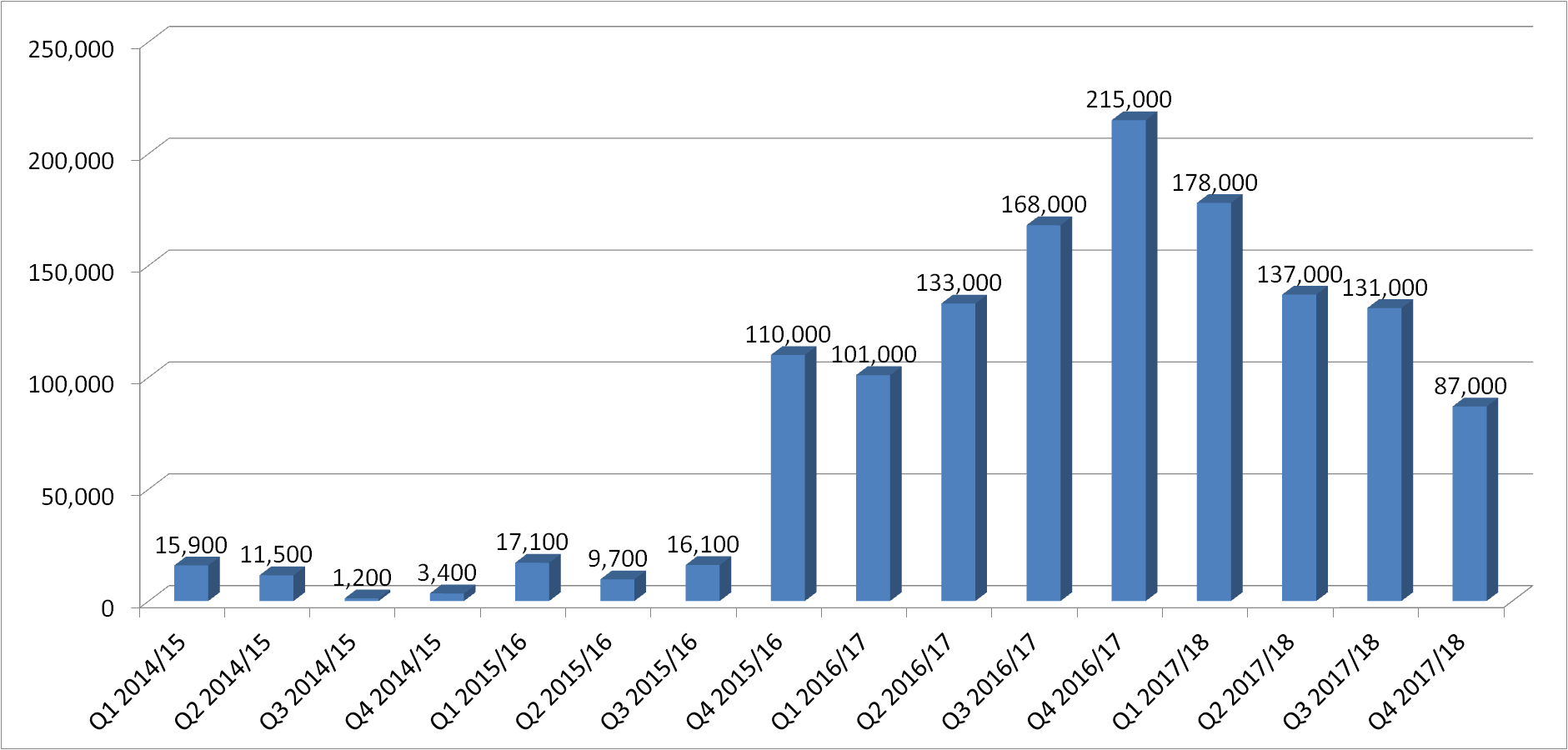

To make matters harder there are a lot of companies all trying to do the same thing at the same time. Staging dates have been staggered, but there is a genuine problem with capacity. An estimated 1.4million firms will be attempting to bring their schemes into life. This is not going to be easy and most of the pension companies that you have heard of are alarmed at the prospect and cherry picking those that they want to work with, some are also simply closing the doors. This will leave pensions that you haven’t heard of as your main choice. Here is a chart showing the staging dates over the next 3 years by quarter. So you are just going to have to trust me on this – get on with the process, wave of applications is going to cause all sorts of capacity problems for pension companies.

So, let’s see how far I can get away with the analogy…whilst you have be currently of the view that you are searching for a new date (Valentine’s is shortly upon us) you are actually already in an arranged marriage and fairly stern in-laws have planned the baby-shower and booked a hotel to be near your local maternity ward…. Well maybe it doesn’t work too well as analogy, but you get the point. Time is running out whilst auto enrolment provides the opportunity for opting out (by employees) employers are not permitted to do the same and under no account permitted to influence employees.

Tomorrow I will outline some of the key issues that have little or nothing to do with pensions, but everything to do with compliant auto enrolment… after all how many small firms can afford fines of £15,000 a month?

Dominic Thomas: Solomons IFA