Assumption

Assumption

You will have probably heard the saying “assume – makes an ass of u and me”. Whilst this holds some truth, it naturally requires context. As financial planners, we make assumptions about the future all the time, but equally we review these on a regular basis.

Watergate Bay

Like most people, I have picked up the occasional parking fine in the course of my driving lifetime, most, on reflection, were fair. One more recent experience, where I paid and displayed, resulted in a fine as my ticket “wasn’t seen”. I didn’t keep the original ticket, (does anyone?) so I had no evidence to affirm my claim. Reluctantly I paid the fine, which left me with a fairly bitter feeling towards the car park at Watergate Bay in Cornwall and its fine dining (yes, I have an irrational streak).

Court Orders Woman to pay £24,500 in parking fines

The headline above grabbed my attention. You can read the full story here about how Carly Mackie managed to accumulate fines that she could have avoided fairly easily – if only she had paid a small monthly fee. This would have permitted her to park in exactly the same spot, but ensuring that she could do with peace of mind, legitimately.

Price and Value

This reminded me of the mess that people can get in because they don’t see the value of a maintenance agreement. OK, it doesn’t necessarily hold true all the time, (electric goods “service agreement”) but it made me think about our services to clients. We provide an ongoing service to look after your financial “stuff”. We keep you posted about changes to rules and your arrangements. The purpose in doing so is to help prevent a larger expense later, because something was missed or not known. The problem with any such service is that most people see the price not the value. They assume that this aspect of life is all very straight-forward and any such service is an unnecessary cost. In fairness, it doesn’t help that the point of the service agreement is to do precisely that – to avoid unnecessary cost and making things appear to be simple.

Are you still paying attention?

I don’t wish to overstate, but a phrase that comes to mind is “those that pay, pay attention”. In other words, if you don’t really pay (enough) for something you tend not to value it. If you don’t value it, you probably ignore it….which can lead to problems.

Whilst some aspects of financial planning are “blindingly obvious” – such as spending less than you earn. Some are not (think new tax on annual pension allowance excess). Also, if nobody is around to challenge you on some “obvious” stuff, who will keep you on track? There are some “basic” traps that most people fall into…. Ready for it? (this is basic, but uncomfortable)…. If you spend more on your car each month than you put towards your pension, you are set for a miserable retirement. Most cars are monthly payment plans. It’s true of your holiday spending and so on… your pension is your future income stream, not an optional extra.

How is that coffee smelling?

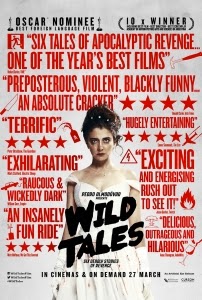

All of which reminds me of one of the short films (Bombita) within “Wild Tales” (one of my favourite) about a demolition manager who takes the law into his own hands after dealing with the city parking bureaucrats.

Dominic Thomas

Solomons IFA

You can read more articles about Pensions, Wealth Management, Retirement, Investments, Financial Planning and Estate Planning on my blog which gets updated every week. If you would like to talk to me about your personal wealth planning and how we can make you stay wealthier for longer then please get in touch by calling 08000 736 273 or email info@solomonsifa.co.uk