How are you spending your time?

Jemima Thomas

April 2023 • 3 min read

How are you spending your time?

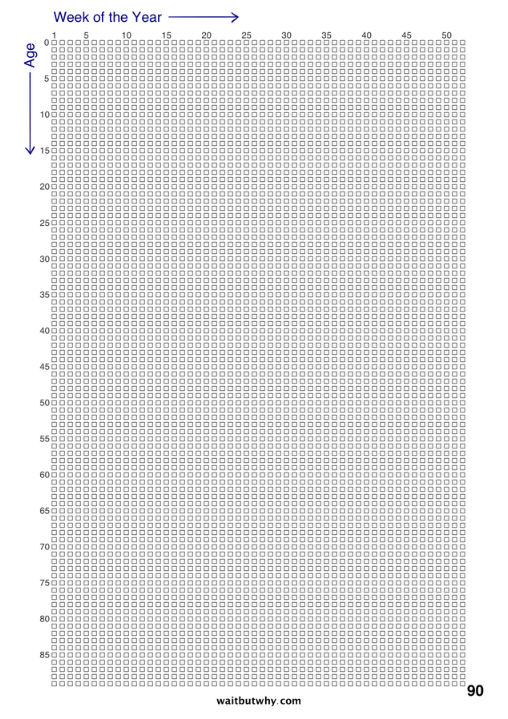

We always want our clients to be able to prioritise what enriches them in life. We hone your financial plan to suit your needs, with an eye on making sure that your spare time is spent doing what you love with ‘financial comfort’ making that possible. With a fair few bank holidays on the horizon, we hope that you have been able to set some time aside to spend it doing the things that bring you joy.

We’d love to hear how you are spending your long weekends in May. Will you be surrounded by loved ones? Engaging in a favourite hobby? Travelling somewhere? Or simply taking time to relax and breathe? Whatever you have planned we hope it’s thoroughly enjoyable and gives you the opportunity to rest and recharge.

Spotlight (our client magazine) is due to be in your hands very soon, and as usual we’ve had a number of clients who have contributed. It’s always lovely to be able to present real examples in Spotlight of lives well lived – which is why we do what we do here at Solomon’s; Time well spent deserves to be celebrated and your story shared.