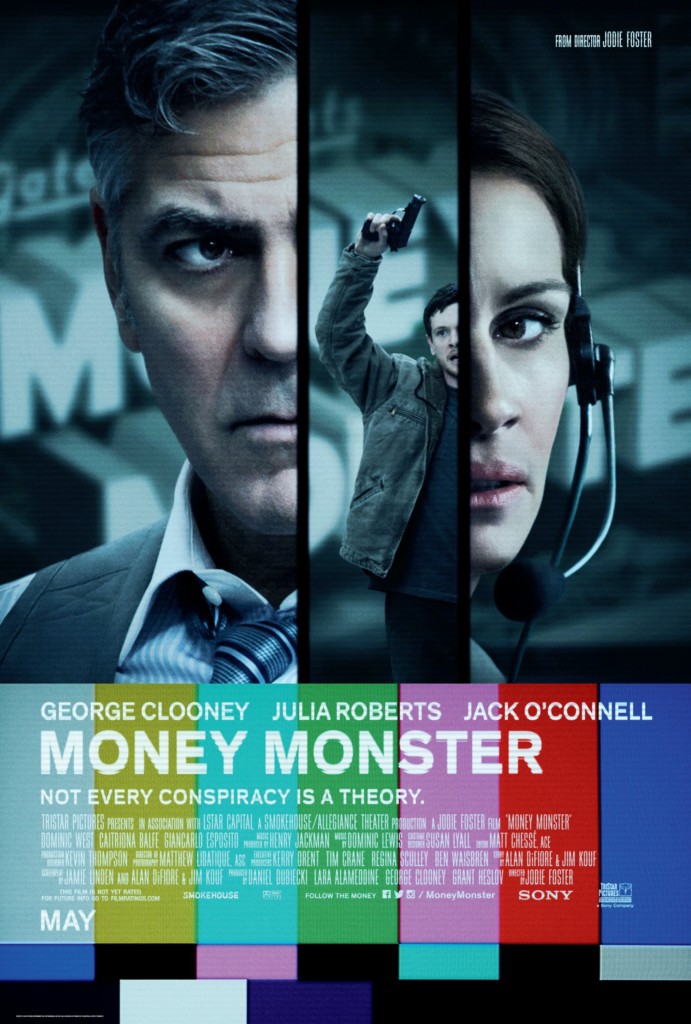

Money Monster

Money Monster

The latest George Clooney movie is on general release. It continues the theme of some elements of Hollywood questioning the current state of capitalism, yet recognises that the language used within financial circles is almost impenetrable and many feel so powerless that the impetus to understand is invariably lost.

Clooney plays Lee Gates, one of those dreadful money pundits on American TV stations that constantly cover the markets. If you have ever had the misfortune to tune into this sort of television you will know precisely what I mean. He is the worst sort of journalist – a TV presenter, who comments on markets and shares without context or thought of consequence. Regrettably this is not exclusive to the US, but within our own media too – both televised and written. The tempo may be different, but the problem is essentially the same. This is, for want of a better term, financial porn.

Financial Porn

Any glance at any financial publication over the last 10 years will reveal the same rather sad truth – the media appear to have little choice but to grab our attention with ever depressing or outrageous headlines. This reflects on us all and our overstuffed in-box lives, to which I am both a contributor and recipient.

The story itself revolves around Kyle, an irate investor who followed Lee Gates’ advice, but sank all his savings into this one “sure thing”. The stock collapses due to a “computer glitch” and he loses a lot of money. Kyle takes matters into his own hands, armed and in search of answers, takes the TV studio hostage. It’s a decent movie.

Lessons for investors

There are some obvious lessons for investors here. Firstly, all investment should have a context. There is no such thing as certainty, some things are much more likely than others, but not certain. I cannot guarantee that the sun will rise in the morning, but we all expect it will, but it’s not guaranteed. Do not invest all your money into one stock. Do not bet your future on a tip from a TV pundit or any other journalist – none of whom are accountable for the “advice” (that isn’t advice). Finally, in the event that the stock or investment collapses, few investments ever reduce to a value of nothing. It certainly is possible for a company to go bust, hence its share price worth “nada” but most investments are not single stocks. So you will not have “lost all your money” if the investment has a value, so does your investment. Ironically, in the film, the loss Kyle experiences would have been made far worse by the resulting story, not better.

I enjoyed the film, it poses some good and frequently asked questions. I would be happy to recommend it to you, about what not to do with your own money. Here is the trailer. It’s out now.

Dominic Thomas

Solomons IFA

You can read more articles about Pensions, Wealth Management, Retirement, Investments, Financial Planning and Estate Planning on my blog which gets updated every week. If you would like to talk to me about your personal wealth planning and how we can make you stay wealthier for longer then please get in touch by calling 08000 736 273 or email info@solomonsifa.co.uk