Planning – Christmas is coming

Debbie Harris

Dec 2022 • 6 min read

The goose is getting fat, Christmas is coming

As I write, it is the middle of November, but we are galloping towards the festive season at a pace – bombarded by supermarket adverts, neighbours putting their fairy lights up (already!), and the internet promising fantastic bargains if you are willing to part with your money on one particular day of the year.

It all seems so frenetic (and it is), but this year I have decided to slow things down a little; get my priorities in order; and be mindful during the planning process (there it is … the P word!).

As a financial planning firm – these are three things that are crucial to a job well done and a job done well.

1. SLOW DOWN

Hit the ‘pause’ button; take a break; stop – you cannot see the wood for the trees if you are running around the forest like a headless chicken

2. PRIORITISE

Figure out what is important; what you really care about; what matters – only in reflection and introspection do these things become clear

3. BE MINDFUL IN THE PLANNING

It’s all very well to have grand plans and ‘big goals’; but we HAVE to be realistic around what can be achieved with what we have. That visit to Lapland to race red-nosed reindeer will have to be put on hold! We must also remember that time is a finite source – things can be done with all the time in the World; but we don’t have the luxury of that – our tomorrow is never guaranteed

PLANNING – ENJOY THE FRUITS…

All that in mind, I have booked tickets to see a pantomime with my daughter this year (Cinderella ON ICE!); I will be attending a choral performance at a theatre (on my own – I couldn’t convince any of my lot to join me!); I have a ‘Christmas Jumper Evening’ at a pub scheduled next month and I have arranged a shopping-followed-by-dinner date with my siblings. All things that bring me joy; all things that I have carefully selected to do with my time; all things that I will be able to look back on with a smile.

I’m not so worried about ‘the big day’ itself (although I have ordered my turkey … who knows whether I’ll actually get it … bird flu has wiped out huge swathes of the turkey population across the UK this year) – there’s always a slightly anti-climatical feel to the day for me – I enjoy the build up; the anticipation; the socialising – but once the turkey and trimmings have been devoured; it’s all over and there is a sadness to that – the tinsel doesn’t look so shiny; the leftover orange creams in the Quality Street Tin look resigned to their fate; and the tree is a dry, droopy version of its former glory.

I always enjoy the post-Christmas clean-up to be honest … it always feels good to clear away the (admittedly pretty) clutter and start the New Year with a clean, fresh slate (one of the reasons why I love Mondays too I think!)

So whatever your Christmas will look and feel like; whatever your preferred ways are to spend your time; whatever your beliefs about gifting and celebrating; I hope that you are able to plan your festive season mindfully and to execute your plan beautifully.

You can read more articles about Pensions, Wealth Management, Retirement, Investments, Financial Planning and Estate Planning on my blog which gets updated every week. If you would like to talk to me about your personal wealth planning and how we can make you stay wealthier for longer then please get in touch by calling 08000 736 273 or email info@solomonsifa.co.uk

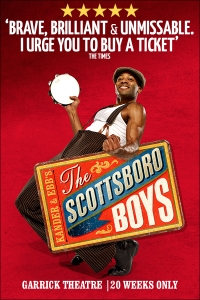

he juxtaposition of black men playing white men (and women) in a parody of Minstrel Shows, further revealing how misguided and disrespectful such things were/are and culminating in a particularly disturbing “blacked up” segment. The creators draw on ideas from Cabaret and Chicago, using song and dance harmonies to hide but reveal the discord. A criticism I would have is that the show isn’t very energetic, rather “sedate” but then perhaps this is quite deliberate, given the restrictions of prison and a hot box… and the final scene of powerful protest.

he juxtaposition of black men playing white men (and women) in a parody of Minstrel Shows, further revealing how misguided and disrespectful such things were/are and culminating in a particularly disturbing “blacked up” segment. The creators draw on ideas from Cabaret and Chicago, using song and dance harmonies to hide but reveal the discord. A criticism I would have is that the show isn’t very energetic, rather “sedate” but then perhaps this is quite deliberate, given the restrictions of prison and a hot box… and the final scene of powerful protest.