Has War Just Changed?

Has War Just Changed?

As is often the case, out of something that seemed trivial, we may have witnessed a “significant moment” in history without grasping the implications. In short, we are asked to wonder if war has just changed. It seems to me that war is invariably about an inability to cope with or live with difference. Often this is expressed as a conflict of ideology but of course theology too. Some regard war as a battle over land, which perhaps is the case, but I’d suggest that this is merely the physically binding frame of reference used to galvanise support along lines of difference and to physically represent the boundaries of control. This week we learned that the boundaries shifted. The vast majority of the media missed the story, selecting to reflect the inane rather than the insane.

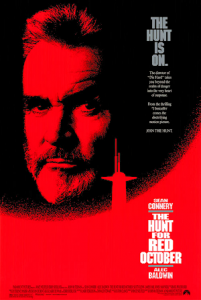

The story? this is about a executives at a film company bad-mouthing movie stars and being caught. The real story is that national boundaries have just been obliterated by hackers, who acted to squash something they didn’t like… but not just squash, threaten. Of course, some countries operate on the basis of a few bullies oppressing the masses – this is sadly nothing new and will probably never cease. I found myself looking at an image in a magazine recently, wondering how on earth so few, odd looking irrelevant men can control an entire nation, yet it happens all over the world.

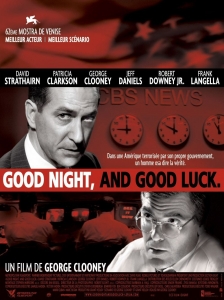

The sadness is that film-makers and journalists are meant to be the ones that keep our focus on the truth, revealing darkness and oppression, helping to inform and change. Sadly many in Hollywood shirked this responsibility for fear of reprisal and financial cost. George Clooney couldn’t get anyone to sign his petition – ANYONE. So why should we be concerned if others aren’t? – after all haven’t Sony executives themselves to blame for expressing personal opinion and hitting that send button? Well, certainly some wisdom is needed in expressing opinion in a digital age, but the truth is that I doubt anyone has not said something about someone at some point in their life of which they are now not terribly proud. However, this isn’t really the point – the point is where does this lead? Can hackers now be hired by anyone, any nation to bully another into compliance? How does this impact our free speech? and surely this isn’t simply the domaine of terrified, narrow-minded tyrants, but also enters the arena of corporations who don’t like stories about their leadership or activities. Surely this has the potential to influence how we perceive and from a financial services perspective, appearance can be everything – just ask Tesco or BP.

This story has implications for you and I, our use of social media and the freedoms we enjoy. Obviously it isn’t wise to hurl insults and the adage, if you wouldn’t say it to their face, don’t say it at all seems pretty pertinent. But we surely cannot live in a world where we are terrified of legal action or reprisal. This is a “tipping point” for the double-edged sword of the internet, offering the prospect of genuine freedom of information to all (which we take rather for granted in the comfort of the West). As for me, I have never liked bullies, whether they come in the guise of a big kid in the playground, a teacher, boss, an investment bank, politician, pseudo military general, bigot, racist, rabid fundamentalist or of course my own tendency to think lazily and turn to petulant expression in frustration, which certainly in my “madder moments” it is a very good thing that weapons are not within easy reach…and sadly my own temper is easily fuelled driving, cycling or walking these very streets all too easily… which is of course the advantage of a society that doesn’t permit liberal gun ownership, encourages thought, education, tolerance and self-reflection, but unfortunately often seems more obsessed with narcissistic reflection in the eye of… well the media.

Dominic Thomas