Business owners heed lessons from online retail

Graham Jones is a man that knows a thing or two about the web and our relationship with it. He is an internet psychologist with a lot of useful insights, in particular for those that own or run a business in the UK. Here is his latest piece to get business owners thinking – which includes me. So let me know how I can help you too.

Business owners heed lessons from online retail

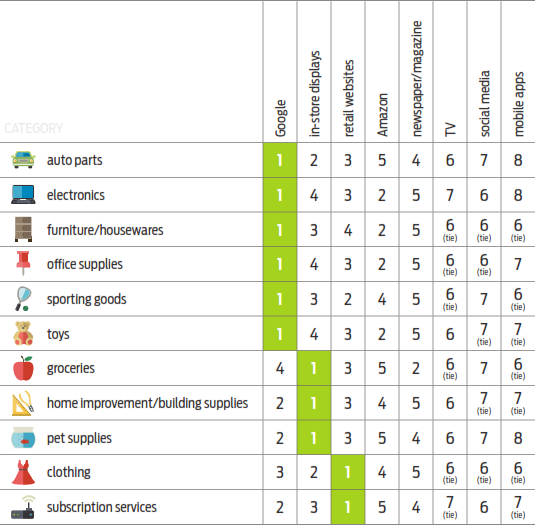

Where do you go to buy things these days? The chances are you use a variety of sources – local shops, out-of-town retail parks, town-based shopping centres and, of course, the Internet. However, increasing amounts of evidence show that the starting point for our purchases is the web, with Google being our “number one” place to go to start our shopping journey.

The latest piece of research comes from the incentives company, Parago. They found that the majority of shoppers begin their decisions about what to buy on the web. It means that if you are not using your website as central to selling, you are missing out – big time. Only for groceries, building supplies and pet supplies do people choose a retail store as the first port of call – though second on the list is either Google or Amazon for those shoppers.

But look deeper into the figures. They show that your products and services need to be found on Google – but that you also need to be on Amazon and have your own retail website too, if you are to pick up the most shoppers. Indeed, even for subscription services, people prefer to look for you on Amazon than in social media.

The study also found that the time taken to buy something is now down to 2.25 days. That suggests that if you don’t follow-up website visitors immediately, then you are losing out on sales because the decision to buy will have already been made if you wait more than a day or two to contact people.

In other words, to sell these days you have to be fast and you must have the web as central to your sales process.

Graham Jones