Keep it Real

Keep it Real

If one were to believe the media, there are many reasons for none of us to sleep at night through anxiety of our impending doom. However, whilst I wouldn’t wish to trivialise any of them, few in practice will have much impact. However for investors, there is one enemy that will do more to damage a portfolio than many other threats. That is “inflation”. This is a topic that I regularly discuss with clients, particularly someone new to our approach.

Hold cash, but not too much

Many people mis-manage their wealth by holding too much in cash or not being bold enough with their investments. I say this as someone that believes that holding cash is a good thing – wise, as cash provides liquidity – or at least it should in the normal course of life, providing for emergency funds and planned and unplanned expenses. However cash generally provides a poor return and one that few people can really afford.

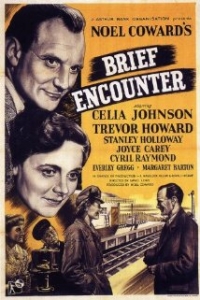

The price of a cup of tea

Inflation is, at its most simple, the rising cost of living. I was reminded of this yet again on Friday as I attended the London Philharmonic Orchestra screening of the David Lean 1945 film “Brief Encounter” at the Southbank Centre. Much has changed in society since 1945 (a mere 69 years ago) particularly the days of buying two cups of tea and a couple of buns for 7 pence. I do appreciate that this was pre-decimal, but you get the point. So if building a portfolio it is helpful to know how long the portfolio needs to last, the longer its duration, the more likely the negative impact of inflation. The regulator has attempted to alert investors to this problem, by making providers quote returns with allowance for inflation. Invariably this makes the numbers look somewhat depressingly low and even negative, prompting the obvious sensible question “why invest?”.

Long-term impact

If you have our APP for i-phone, i-pad or Android, you can use it to review inflation in a specific year or over a particular timeframe. The calculator goes all the way back to 1949. I usually show investors the rate of inflation in their year of birth and then the average rate since then. Inflation has only really come “under control” since the early 1980’s as the longer-term rate remains within 2.7%-3.7% range. So for real growth to happen, investments must beat inflation, otherwise they are either simply keeping pace or falling behind. Of course investments will rise and fall in value so even in a conservative portfolio if inflation is 2% and returns are -3% over 12 months, then you are making considerable losses, over that time – however a longer-term perspective must be taken to have any practical use for investment assessment. In order to ensure the value of your pound increases, it must keep pace with inflation. To grow wealth beyond this, we are left with few choices, investment being the most obvious. A good investment experience, will provide returns above inflation, commensurate with the amount of risk associated with it (and how much risk you are prepared to take). As a result, returns that are above inflation are actually “real returns”. As a consequence, we model financial plans in “real numbers”. I believe that keeping it real is vital for any worthwhile assessment of a portfolio.

Dominic Thomas