Dementia – Suppose I Lose It

Dementia – Suppose I lose It

Dementia – Suppose I lose It

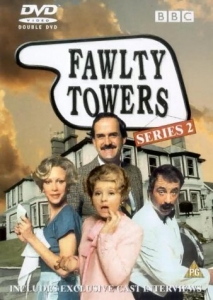

Radio 4 will be running a programme this evening at 8pm, which will be a highly personal view of dementia. It features a well-known married couple – Timothy West and Prunella Scales who are interviewed by their long-time friend Joan Bakewell. The preview this morning sounded enganging, expressing the very practical, personal and real problems that anyone suffering dementia can face.

Becoming infirm is not a topic that many people wish to talk about, yet it is, in my opinion a vital part of proper financial planning. After all, the job of a financial planner is the attempt to make your money last as long as you, ensuring that it doesn’t run out. Yet we all know that should we ever require care at home or in a residence, this can be incredibly expensive and is often referred to as a “ticking time bomb” within press and political circles. One of the scenarios that I model for clients is precisely this problem and of course there are implications for ensuring that not only your Will is up to date, but also that you have Lasting Power of Attorney in place.

The broadcast promises to be interesting and is on this evening at 8pm, Radio 4, called “Suppose I Lose It”. It will be available on the BBC i-player afterwards presumably for the usual time-limited period.

Dominic Thomas