|

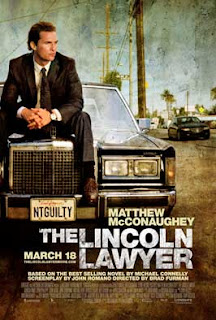

| 2011: The Lincoln Lawyer – Furman |

It may be many years since the UK launched a proper taskforce, but HMRC is effectively going out all guns blazing in its campaign for collecting owed taxes. At the moment they are focusing on Lawyers . It basically works like this, HMRC know roughly how many clients each practice has, therefore it can look at average revenues and spot those that look a little bit low on their declared income. Previously HMRC has attacked Doctors, Dentists, Tutors and Coaches, however Lawyers are the first “high risk” group being attacked by the taskforce.

Other “high risk” groups include the hair and beauty trade in the North East, thought to owe around £3.5m in tax. Restaurants in the South East and Solent are also under review (£2.5m), the Scottish motor trade (£3m) and the grocery and retail trade (£7m). There are now over 30 HMRC Taskforces in operation, all launched since May 2011.

There are various ways to legitimately reduce your income tax. The most obvious being to make pension contributions, which attract tax relief at your highest rate of tax. Charitable Giving is also a way of reducing tax burdens and of course means that your money goes to a source that you are concerned about. If you are need assistance do get in touch, otherwise perhaps some of the no win, no fee cases may be concluding earlier.

We are a boutique firm of financial planners. We create financial plans designed to achieve a desired lifestyle. We will craft and implement your plan that will provide you with the greatest chance of accomplishing your unique goals based upon the values that you hold. Financial products are little more than the tools to achieve your required results

Call us today or visit our website for more information and to arrange a meeting

Call us today or visit our website for more information and to arrange a meeting