TODAY’S BLOG

IN SEARCH OF ANSWERS

I had the unwelcome task of writing to clients to advise that the value portfolios have fallen by over 10% since the start of 2020. The emails that I sent seemed to be well received. Today has been another very tough day for investors (and their advisers). The charts are rather frightening, this comes at a time when we are all (most of us anyway) rather anxious about the state of the world and a deep sense of unease.

So, without wishing to fudge any issues, I thought it best that I re-use the bulk of the content that I have been sending.

It is now a regulatory requirement to tell you when a portfolio falls by 10%. This is a new experience for me, despite being an adviser for several decades. I genuinely believe that this new requirement comes from well-meaning regulation, but is entirely counter-productive, because it is essentially alarmist. I will endeavour to add a little more flesh to the bones.

SHOULD YOU WORRY?

Should you worry? No; but anxiety and concern are normal responses to ‘seeing’ the value of your portfolio fall. Anxiety or fear are normal responses to ‘danger’ or bad news. We are built that way and it is why we have survived as a species for as long as we have. However, the instinct of ‘flight’ is of no use to investors. The stock markets of the world fall in value each year. I would refer you to the various articles I have written about this over the years and remind you that 1 in 4 calendar years have negative returns. This is part of ‘the norm’ and indeed we don’t get the positive returns without the negative. However yesterday’s headlines of the FTSE’s second largest fall in a single day does not really help calm nerves.

UNCERTAINTY IS NORMAL

The problem with investing is that markets are not predictable, despite appearing so. What is predictable is irrational investor behaviour. This is precisely why we ask you to complete an attitude to risk questionnaire. So that a suitable portfolio is constructed for you – one that provides the chance of delivering the returns you need whilst enabling you to sleep at night. You will have experienced similar falls in value before, but either didn’t notice, or were reassured.

WHAT IS A LOSS?

When the value of anything falls, it only impacts those selling. A crash in property prices, impacts those selling their home, most of us do not notice, although it may provide conversation around the dining table with friends or colleagues. Unlike property, the value of equities and bonds are transparently priced throughout the day in a highly regulated market. When you sell your home, frankly the price is a bit of a guess by the estate agent, surveyor and then haggled over by seller and buyer … in practice, a very small and biased market.

The key is not to panic; not to sell. You know this, but we also know it is hard to do. You know that you should sell at the top and buy at the bottom, however as humans we tend to do the exact opposite. I’m not going to pretend that this doesn’t make us all wince and wonder, but equally I will remind you to stick to your plan – yours; not those of a media which seems only intent on making you miserable.

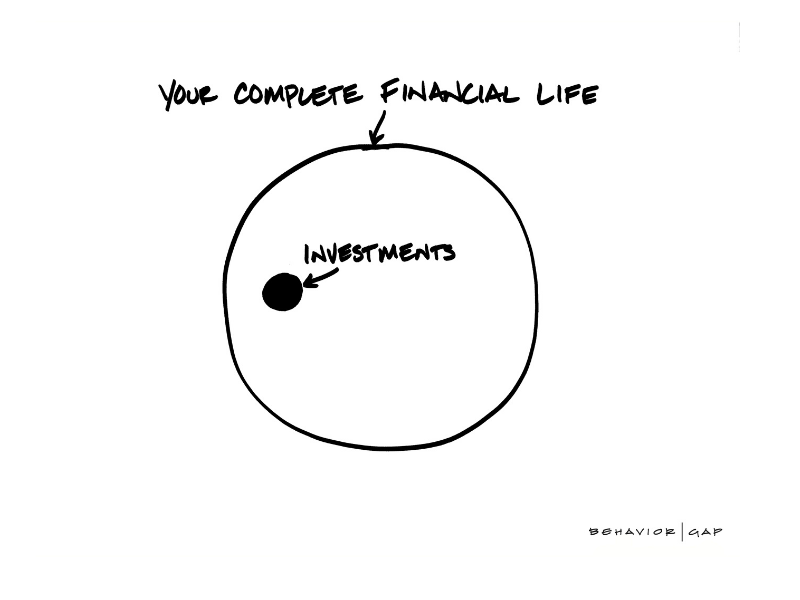

Your portfolio is globally diversified, it is well balanced, it is low cost and it is properly reviewed. We have biases towards smaller and value equities which over time will demonstrate to be better value. There is a huge amount of research that should you wish it, I can point you to. However, I tend to think of that as my job … to help you make better decisions with money and help reduce or avoid all the daft ones.

THE UNCOMFORTABLE TRUTH

If you are investing on a monthly basis, the fall in prices is a bit of a bonanza – because you buy more for the same money. We expect values to rise. They will; it’s just a question of when. For those who add lump sums, similarly now is essentially a discount sale that will not last.

Those who are withdrawing money have a much tougher time. The fall in prices means you sell more holdings to get the same figure out. Thereby not benefitting as much when prices rebound. They will, and you will, but not as much. In an ideal world, you will have discussed and outlined your plans for income or lump sum withdrawals and we have already factored this in. If you need to review this, then please get in touch.

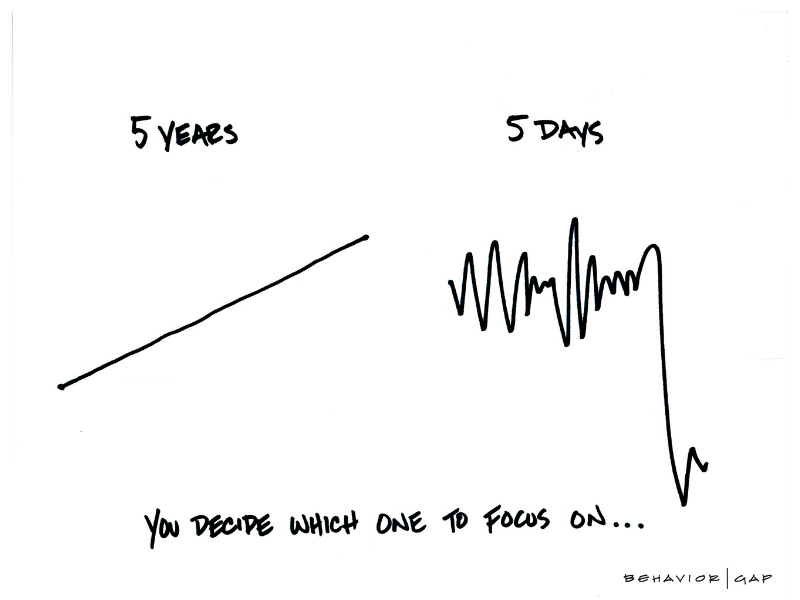

DO NOT OBSESS OVER THIS

Looking at your portfolio each day will never help anyone. It will rarely provide comfort. Worry will not help you to live your life well. You have to trust that the fundamentals of investing will remain true today, next week and next year as they have done over the decades. Yes – there are ‘bad times’, but remember that market returns are positive 3 in 4 years on average, we simply don’t know the order or reason.

You are investing for decades and I have no doubt that this too will pass.

Dominic Thomas

Solomons IFA

You can read more articles about Pensions, Wealth Management, Retirement, Investments, Financial Planning and Estate Planning on my blog which gets updated every week. If you would like to talk to me about your personal wealth planning and how we can make you stay wealthier for longer then please get in touch by calling 08000 736 273 or email info@solomonsifa.co.uk

GET IN TOUCH

Solomon’s Independent Financial Advisers

The Old Bakery, 2D Edna Road, Raynes Park, London, SW20 8BT

Email – info@solomonsifa.co.uk

Call – 020 8542 8084

GET IN TOUCH

Solomon’s Independent Financial Advisers

The Old Bakery, 2D Edna Road, Raynes Park, London, SW20 8BT

Email – info@solomonsifa.co.uk Call – 020 8542 8084