|

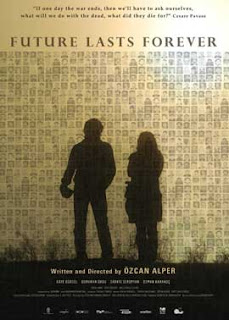

| 2011: Future Lasts Forever – Alper |

Great financial planning tends to involve providing a variety of options to achieve goals. A meeting with a couple recently generated a good example of what I mean by this. The clients want to retire early, before final salary pension schemes would normally begin payment. Having discussed an outline of their required lifestyle previously, at this review, we had more detailed information to work on. They now had quite a clear idea about where they would live and the sort of lifestyle that they required.

Initially I was able to identify that there was a shortfall in their required income target between early retirement and the normal retirement ages of their final salary pension schemes. There were a number of ways that their goals could be achieved. By way of broad example, we considered simply building a fund to “plug the gap” which involves investment risk, although this is very manageable. We also considered part-time work at a much reduced income, moving home to release equity, as well as taking the final salary pensions early incurring a hefty early retirement penalty along with a few other options, including assessing clearing the mortgage earlier. There were lots of options and consequences with each, yet we did not really mention any financial products at this point. A great financial plan will provide you with possible scenarios about the future, not in the sense of depression or optimism, but in the very real, grounded values that a client has and the results that they wish to achieve. A financial planner, well a good one, will help assess what is realistic, help prioritise and design a plan that enables the goals to be achieved. The precise way that this is done using financial products and an investment strategy are very much subservient to this, yet many financial advisers talk about the money and products first, which is the wrong way around and in my opinion leads to poorer results, which may be the difference between having the lifestyle you want, or the one that your adviser picked for you.

Whilst Fund Managers, Stockbrokers, Traders, Dealers, the investment media and a few others may talk about trading in options and futures, the only future that you really should be concerned about is your own and this will have a variety of options to help you build it. A great financial adviser always puts your plans and values together to form a workable financial plan.

We are a boutique firm of financial planners. We create financial plans designed to achieve a desired lifestyle. We will craft and implement your plan that will provide you with the greatest chance of accomplishing your unique goals based upon the values that you hold. Financial products are little more than the tools to achieve your required results

Call us today or visit our website for more information and to arrange a meeting

Call us today or visit our website for more information and to arrange a meeting