THE SPRING BUDGET 2023

Dominic Thomas

March 2023 • 10 min read

Pension reforms of sorts…

If you are under 75 and have a pension, today is a better day than yesterday. You may breathe a sigh of relief; the Chancellor has done something to directly benefit you. As with all Chancellors, there is of course some politics at play. Whatever your view of the rabble at the House of Commons, we finally have a Chancellor who seems to both understand maths and has an ability for some long-term thinking as well as valuing the concept of financial independence in his Spring Budget 2023.

As a reminder, it was the Blair Government who introduced the Finance Act 2004 which ushered in new pension rules from April 6th 2006 known as A-Day and termed “Pension Simplification”. The basic premise was to simplify pension funding, enabling anyone to make payments and get tax relief, restricted by a maximum annual contribution allowance and a lifetime allowance for the value of your pensions, be they final salary or investment based. It sounded so simple, something akin to the battery level on your mobile phone.

Next month, “pension simplification” turns 18 years old. Simple is certainly not a term that anyone would consider in the same breath as pension rules. A veritable smorgasbord of metrics are needed to monitor if you fall foul of the rules.

A-DAY TURNS ADULT

Today though, Mr Hunt has abolished the Lifetime Allowance, a welcome and grown up but unexpected move (it had been hinted that it would return to the level at which the Conservative Government inherited it at £1.8m. No, it’s abolished, completely! The Lifetime Allowance, which is something everyone had to assess pension benefits against will be gone from 6th April 2023. Do not retire before then – or more accurately do not crystallise any pension until then.

ANNUAL ALLOWANCE – UP BUT STILL TAPERED

He has not however returned the Annual Allowance to the 2010 level of £255,000 but has increased it from £40,000 to £60,000. In addition, the Tapered Annual Allowance has not been scrapped, but increased from £240,000 to £260,000 from 6 April 2023. The threshold test at income of £200,000 has not been altered. In theory therefore the new standard annual allowance of £60,000 will still reduce by £0.50 for each £1 over £260,000 but stopped at £360,000 when you will get the minimum maximum annual allowance of £10,000.

By way of example, someone with income of £300,000 would be £40,000 over the £260,000 threshold and thus see the annual allowance reduce from £60,000 to £40,000.

Those of you that have taken income from a personal pension (not a defined benefit/final salary pension) will be able to continue towards a pension under the Money Purchase Annual Allowance (MPAA) which is being increased from £4,000 back to £10,000. I understand this will double up as the minimum maximum (if you see what I mean) that anyone with income over £360,000 can also contribute (gross).

NEGATIVE TURNS POSITIVE

Medics (and a few others) that on occasion have a negative pension value for the year will now be able to offset this, something that was not possible previously.

25% TAX FREE CASH IS GOING FOR BIG PENSION POTS

There is a slight “fly in the ointment”. Under pension rules tax free cash is capped at 25% of the fund value, buried in page 100 of the Budget is the statement that advisers understand but most investors do not. “The maximum Pension Commencement Lump Sum for those without protections will be retained at its current level of £268,275 and will be frozen thereafter”. In other words, the tax free cash lump sum (PCLS) link is to be broken. 25% of the current lifetime allowance is £268,275 and this is therefore being retained, meaning that whether your pension fund is more than this, you cannot withdraw more than £268,275 as a tax free lump sum. In plain a pension fund of £2m does not produce tax free cash of £500,000 (25%) but £268,275.

One other “minor” point is that those with Primary, Enhanced, Fixed or even Individual Protection from 2006, 2012 (max £450,000), 2014 (max £375,000) and 2016 (max £312,500). Therefore some people will have a higher tax free cash entitlement than the new limit of £268,275).

ISAs, JISAs, VCTs, EIS, SEIS

All as previously.

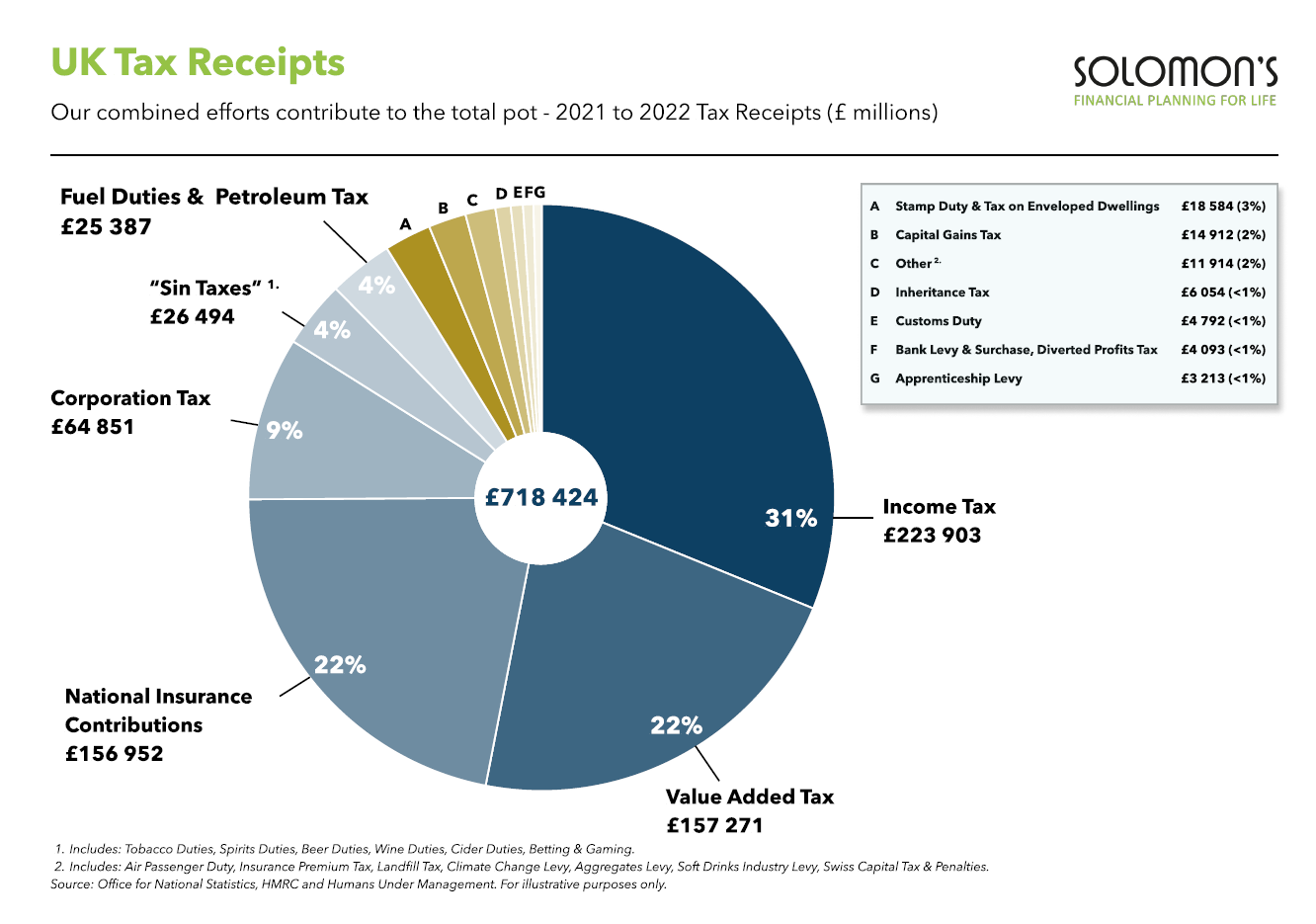

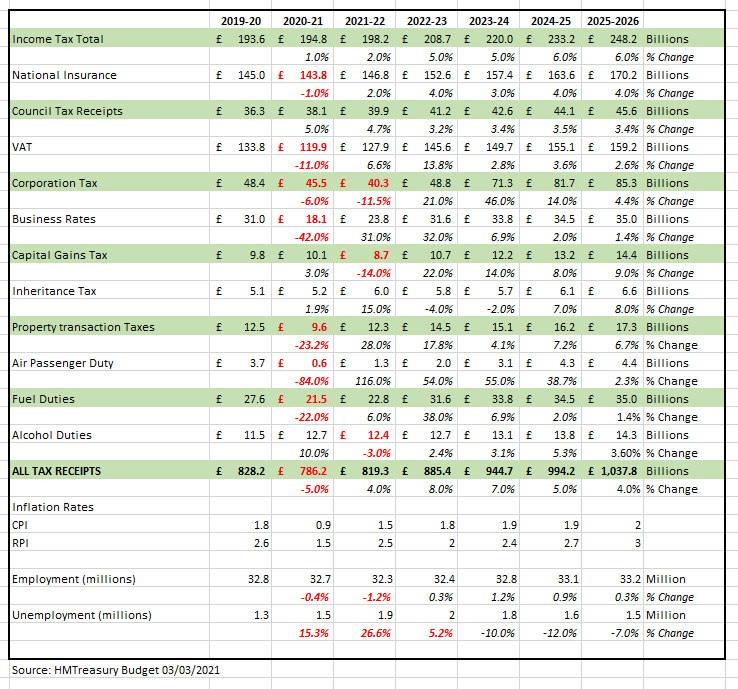

INCOME TAX, CORPORATION TAX, CAPITAL GAINS TAX, INHERITANCE TAX

As previously announced for 2023/24.

On occasion, Budget plans get revised (remember the glove puppet of a PM?) so there is a possibility that after a little more thought, pressure and checking, some of the points in the Budget might need a tweak, but in general this is a rarity.

If you have questions, that I have the realistic possibility of answering (not “where is Cloddach Bridge?” which gets a sum for refurbishment…. which I imagine is one of those times we may remark, “what, a million pounds?” (actually £1.5m) is either a lot or a little, that old price and value thing… much like the criticism that will inevitably be made of the abolition of the lifetime allowance, which is, from my perspective of working with you, a very good thing indeed.