Concepts about investing – theories and generic ideas

ONE FOR THE GARDENERS

TODAY’S BLOG

ONE FOR THE GARDENERS

It has not been easy to find positive aspects of the pandemic, yet I have been fortunate enough to really enjoy working in the garden. I am not an expert, I have generally been handy at knocking stuff down, cutting, chopping and digging, but it took a pandemic to really switch me on to the joy and healing power of gardening and giving it more thought.

One of the surprises has been the short life of many blooms. There was a lot of groundwork, preparation, tending and expectation before the flower finally appeared, only to disappear within a day or a couple of weeks. Thankfully, I planted lots of plants that flower at different times, but the saying “the constant gardener” is very much my experience, different seasons bringing different work from deadheading to mulching.

It occurred to me that there are many lessons from gardening to learn when it comes to investing and indeed running a business. One of the things we attempt to do is equivalent to pruning – we might train some plants along a particular line, some stakes, supports or tied attachments might be needed to get the plant growing in the right direction. Perhaps cutting off some stems, to refocus the plant energy into the direction of the result we seek. We might want to give a plant a little extra care at times, responding to the local weather. That sort of thing.

TENDING YOUR PORTFOLIO

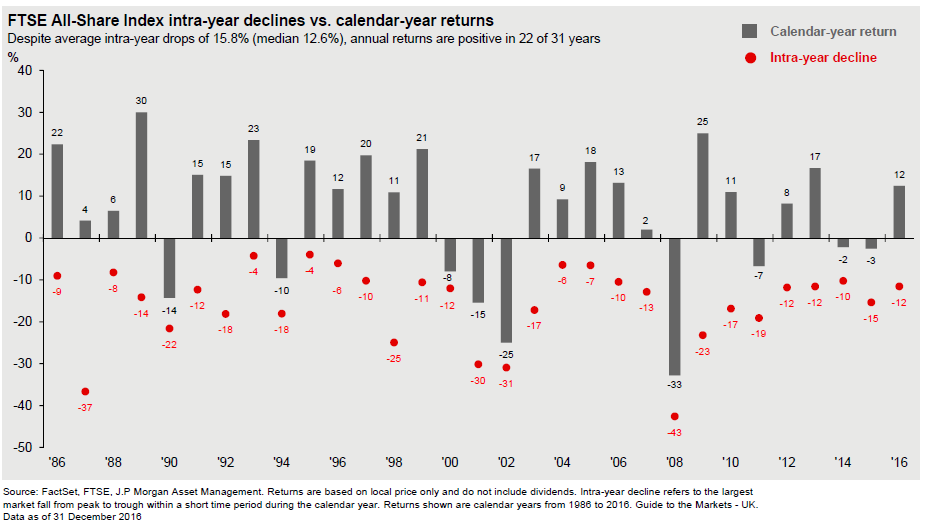

This is similar to rebalancing your portfolio. On a simple level this is taking profits, the discipline of actually buying at the bottom and selling at the top – within a range that makes sense for your planning objectives. There is a sense of tidying up, returning the portfolio to its intended structure, albeit larger and more mature (hopefully). Essentially getting it back on track having been permitted to grow within reason. Left unattended for too long the work becomes more significant and perhaps requiring larger tools and much more energy to do the job.

The problem with rebalancing is that we do need to do this regularly – not every month, perhaps not even every year. There is research about this which concludes that a rebalance adds real value if it’s about every 18-36 months (but not mandated that way). A key issue is the degree of movement away from the original plan – (we call this tolerance). A 10% trigger seems to hold credibility with evidence that this adds value over the long-term.

SEEKING MARGINAL GAINS

I’m conscious though that the process is long-winded. We need to advise you to rebalance or make adjustments, then get your permission and finally implement the changes and check that they have been done correctly. You are busy and probably get fed up saying “yes please do that” each time I ask you to confirm your permission. As a result, we are advising use of a Discretionary Fund Manager (DFM) to implement these changes based on agreed criteria. This means that there won’t be delays in optimising your portfolio, no need for you to agree each minor adjustment.

Normally I am not a fan of a DFM, but this is a fairly unique solution. Its incredibly competitive at 0.09% and takes an evidence-based approach using low-cost funds in a way that matches our own approach and investment philosophy.

Occasionally in gardening some decisions need to be made about what is altered to give the best chance of obtaining the results you seek. At your next review I shall be explaining what pruning, weeding, digging, mulching and reorganisation needs doing for your planning of future harvests

Dominic Thomas

Solomons IFA

You can read more articles about Pensions, Wealth Management, Retirement, Investments, Financial Planning and Estate Planning on my blog which gets updated every week. If you would like to talk to me about your personal wealth planning and how we can make you stay wealthier for longer then please get in touch by calling 08000 736 273 or email info@solomonsifa.co.uk

GET IN TOUCH

Solomon’s Independent Financial Advisers

The Old Bakery, 2D Edna Road, Raynes Park, London, SW20 8BT

Email – info@solomonsifa.co.uk

Call – 020 8542 8084

GET IN TOUCH

Solomon’s Independent Financial Advisers

The Old Bakery, 2D Edna Road, Raynes Park, London, SW20 8BT

Email – info@solomonsifa.co.uk Call – 020 8542 8084