Planning for your estate to pass to your beneficiaries, reducing inheritance tax

IS INHERITANCE TAX AVOIDABLE?

TODAY’S BLOG

IS INHERITANCE TAX AVOIDABLE?

News this week that the taxman is set to take a record amount of inheritance tax for 2018/19 is perhaps not too much of a surprise. Most years the amount of inheritance tax paid rises. Arguably the least popular tax – sometimes called death duties, this is the tax that applies once you die to your worldly wealth.

It is generally the case that if you are married, it is only paid once the both husband and wife have died. This final day of reckoning, tax-wise generated £4.5billion in the first 10 months of 2018/19. A new record high.

It is surprising that despite complaining about the tax, most people do little about it. IHT is one of the few taxes that is avoidable by arranging your affairs sensibly in advance.

5 QUICK TIPS

1. Consider taking out an insurance policy to pay the bill. Admittedly this has a cost and does not remove the bill, but it does enable your real wealth to be passed on to those you want to receive it, rather than the Chancellor. A simple joint-life second death policy placed into Trust will suffice.

2. Have a Will and review it. This will ensure that your estate is passed to the right beneficiaries and you may also nominate charities. Gifts to charities are exempt from any inheritance tax.

3. Know your limit. Everyone has a limit known as the nil rate band. This is the first £325,000 of an estate – the net value (assets less liabilities). If you have a property this can be increased (complicated but it will increase). Couples double up on these. You can find more detail within out FREE app about this.

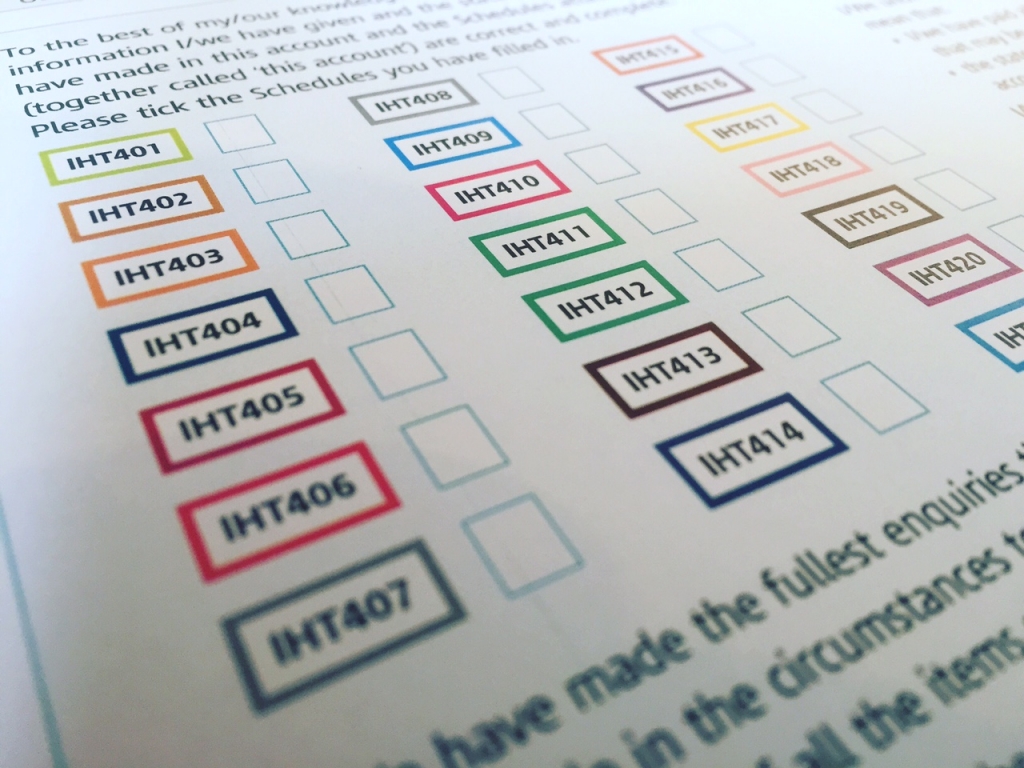

4. Consider using IHT exempt investments, this is really not for everyone, but is certainly a possibility. The most basic being business owners have certain exemptions – technically known as BPR, as does owning woodland or some aspects of farming. You can also hold some AIM listed shares which will be exempt – but be warned all these options have pro’s and con’s.

5. Spend money from the right places. Under pension reforms, it is possible to pass on the balance of a pension fund free of inheritance tax. So if you have the option, you may wish to use up other investments that will be subject to IHT first. Context is everything and thought needs to be given to this from an income tax angle and investment approach.

There are other options too, so if you would like to discuss how you can reduce inheritance tax please get in touch. However, if you are married and have a net estate worth less than about £1million you probably wont have any inheritance tax.

And finally a reminder about our app, which is loaded with all this information.

Dominic Thomas

Solomons IFA

You can read more articles about Pensions, Wealth Management, Retirement, Investments, Financial Planning and Estate Planning on my blog which gets updated every week. If you would like to talk to me about your personal wealth planning and how we can make you stay wealthier for longer then please get in touch by calling 08000 736 273 or email info@solomonsifa.co.uk

GET IN TOUCH

Solomon’s Independent Financial Advisers

The Old Bakery, 2D Edna Road, Raynes Park, London, SW20 8BT

Email – info@solomonsifa.co.uk

Call – 020 8542 8084

GET IN TOUCH

Solomon’s Independent Financial Advisers

The Old Bakery, 2D Edna Road, Raynes Park, London, SW20 8BT

Email – info@solomonsifa.co.uk Call – 020 8542 8084