Broken Promises

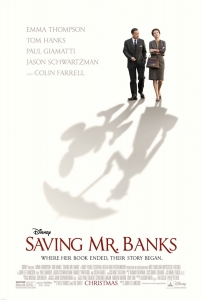

At a recent client meeting I attempted to convey the issues regarding perception of financial advice. In the past most of my industry has lured investors with the promises of riches or security. Whilst both of these are possible to some extent, in practice they have tended to be un-bankable promises, or as Mary Poppins might say “a pie crust promise, easily made, easily broken”. Mary Poppins in mind, my industry is in need of some saving… and its an excuse to use a play on words and suggest a very good film to see “Saving Mr Banks”.

We have certainly seen our fair share of broken promises within financial services, not simply those of servicing but of delivering results. Little wonder so many have such little faith or trust in my industry. So as I am as much part of the system, I too must take some responsibility for the collective failure; indeed regulatory fees ensure that I am constantly aware of the failings of others. Together with all remaining firms, I pay towards the compensation for their failure, which certainly feels like punishment by association. So within this context of “self-awareness” I bring to your attention one inescapable truth.

You probably do not need to achieve huge returns to achieve riches or get too concerned about your security… I appreciate that there are bound to be some exceptions. However for most people, financial planning is about ensuring that your existing lifestyle continues for the remainder of our life, however long or short that may be. In short, that you have enough to live the way you do and ideally the way you would like to. The important thing is to know what return you need to achieve, not simply to “go for it”. Pause to reflect on the athlete, that trains for the 100m. He or she doesn’t simply stroll up to the race without having prepared… for months, perhaps (probably) years. There are hours of preparation in the technique, rest, diet and so on.. then knowing what is required to compete… little point if you run the 100m in over 15 seconds (still a very impressive feat).

Financial planning is largely about discipline, there is some preparation. Practice is perhaps the harder analogy, there is a sense in which this is very much a live learning exercise…so there is no real “practice”. Yet thinking a little larger, today’s personal budget control is an important prelude to one further down the track. The value that clients derive is partly from the experience of the adviser, much like a doctor, each case is new, but years of experience help provide the most effective course of treatment.. but sometimes we need to do a fair amount of research and ruling out to help inform a best judgement.

Life is uncertain, there are no guarantees… even death has its question marks. Financial planning can offer guidance, shape and focus, however it cannot provide guarantees. Here is the official trailer for the fabulous “Saving Mr Banks”.

Dominic Thomas