As safe as houses…. more IHT

You have probably heard that the nil rate band or inheritance tax allowance is increasing on a main residence, provided that it is inherited by your family and provided that it isn’t worth too much. As probably intended, many are under the impression that this new “£500,000” allowance has started… it hasn’t and many will not see the benefit.

For starters, the new “Main Residence Nil Rate Band” … MRNRB is being gradually introduced from April 2017 starting with an extra £100,000 rising each tax year by £25,000 until the full extra £175,000 becomes applied from April 2020. However if the net value of the estate is worth more than £2m, then this extra allowance is gradually lost. I think that’s called giving with one hand and taking with the other and of course is ignored by those who think that this is a tax break for the super rich…. reality is quite different.

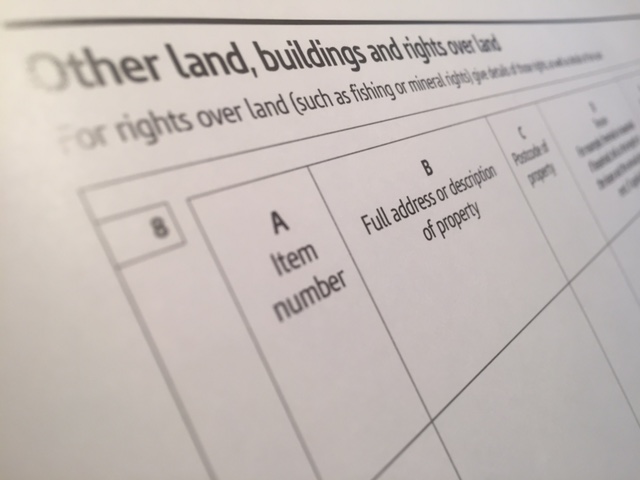

IH405

IHT405 is the form you use to tell HMRC about all of your properties upon death. Have a look at the form, the valuation of a property (or plural) can and will make a considerable difference to the value of an estate. If you have a second (or further) property, then please keep really good records about it. This includes dates and purchase prices, valuations, work done, insurance costs and so on. You need to be fastidious in your record keeping… not least because these records may also be pretty vital whilst you are alive.

Getting your house/s in order

If you have acquired property over the years, perhaps just for your own family use or perhaps as a commercial concern to generate rental income, this all needs accounting…(sorry for stating the obvious). The value of property obviously changes and there is some degree of flexibility in how this is valued for probate… on the basis that what someone will actually pay for a property is more fluid than a simple figure.

As an aside, landlords that are off-setting interest against rental income, thereby reducing profit and tax, are having the amount permitted altered (another feature of the last Budget). So beware! Also as an aside, those with second properties that have soared in value are loaded with capital gains and thus subject to capital gains tax. There are ways to manage this… which I shall outline at another time – but be advised that there are solutions that may appeal.

Dominic Thomas

Solomons IFA

You can read more articles about Pensions, Wealth Management, Retirement, Investments, Financial Planning and Estate Planning on my blog which gets updated every week. If you would like to talk to me about your personal wealth planning and how we can make you stay wealthier for longer then please get in touch by calling 08000 736 273 or email info@solomonsifa.co.uk