Auto Enrolment Fines – Workplace Pensions

Auto Enrolment Fines – Workplace Pensions

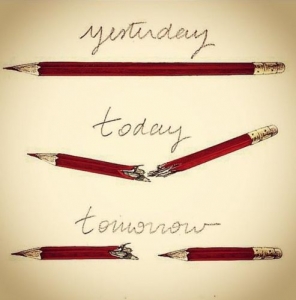

As expected, the pensions regulator is taking auto enrolment (workplace pensions) rather more seriously than it took stakeholder pensions. Employers were warned about the prospect of fines and as the number of firms that should have started their pensions has multiplied, so have the fines. This is unlikely to alter as the momentum increases. This year medium sized and some small firms will be expected to comply with the rules. 166 penalty notices were issued in the last quarter of 2014 and over 1,100 compliance warning notices sent to firms.

Avoid the Fines

Employers need to get on with their auto enrolment compliance. In practice this is a project management exercise rather than about finding a good pension. As a result I advise employers and Accountants to use the very low cost software from AE in a Box. It enables you to fully comply in time and avoid fines. Importantly it is an ongoing project – much like PAYE is an ongoing project, so data and processes need to be adhered to strictly.

AE in a Box

AE in a Box is very inexpensive, £79+VAT to set up and then £29+VAT a month thereafter. The monthly subscription will only begin 6 months prior to your staging date. I would urge you to consider this bit of kit. It isn’t a financial product, its a tool to help you do the job yourself, cost-effectively rather than getting a more expensive planner like myself involved.

Dominic Thomas