Tax, Votes, Spending and Debt

Tax, Votes, Spending and Debt

In the UK, despite our unpredictable and often disappointing weather we are undoubtedly in a very privileged position, some of the richest people on earth. We can easily forget our liberties and the many advantages we enjoy and should be unsurprised that others might wish to come here to create a future for their own families. Whilst we clearly need to exercise care in who we allow into Britain, we are all here largely by chance.

Tax

I’ve been reflecting on history and taxation and to be blunt, was surprised by my own naivety. As taxpayers, at least here in the UK, we get to vote (unless you pay tax and are under 18). This is perhaps the best example of “money talking” if you pay tax; you have an interest in how it is spent and why. One might build an argument for those that do not pay tax, should not have a vote (remember that there are various forms of taxation, not simply income tax – VAT, stamp duty, road tax, council tax and so on)… fairly hard to see how any adult in Britain would possibly be a non-taxpayer (unless they don’t live here).

Votes

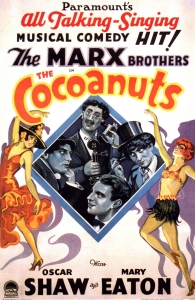

Anyway, what I had forgotten or perhaps not appreciated was the involvement of suffragettes in the taxation system, who argued that taxation without representation (political) was unjust. Today it seems hard to imagine a counter-argument or why women would have been prevented from voting. Yet many women today are paid less than their male colleagues for doing precisely the same work. On occasion this is obvious, but sometimes it isn’t and frankly this is seriously out of order with where we ought to be by 2014.

May I ask you a question? When you initially read “those that do not pay tax should not have a vote” did you have a reaction to a fairly bold statement? Most people would think immediately of income tax and recall that not everyone pays income tax… many of the elderly, the infirm, unemployed and of course some parents looking after children. To deny these of the right to vote would be somewhat outrageous right? But most people pay tax, invariably through “indirect taxes” that we tend to forget about when we consider our actual net income. We are now in a period of confusion about tax avoidance, when terms are being quite deliberately muddled or misrepresented. Who really believes that the state should fund nothing? (or very little? or conversely everything?). There is a societal dynamic to taxation, yet our disconnection from community and engagement in politics tends to repress this social (not socialist) memory. Tax is good for us, but that does not mean that we should assume that paying less tax is “bad”. We are encouraged to save for our own futures by having some tax advantages (pensions and ISAs) or to encourage entrepreneurialism – which hopefully creates jobs and greater wealth. These are designed ultimately to reduce reliance upon the State.

Spending

However I am concerned by politicians that seem to think that reliance upon the State can be reduced before independence is even achieved. The new pension rules are undoubtedly liberating, but please remember that “once it’s gone it’s gone”. This isn’t a “bad” thing, it is simply the reality of living within our means. The main problem being that most people don’t and the reason they don’t is due to the cost of living and an inability to say “no”.

I am conscious that it is very easy for a financial planner with wealthy clients to say this. Surely just a bit of self-discipline is required. Just say no… which I believe, but am also aware of my own hypocrisy. I am just as inept in some aspects of self-discipline. The most obvious for me is my fondness for wine and good food (which sadly in middle age does not mix well with an Adonis physique). I also have the ability to spend money on things that I don’t really need, but would like. Again, there’s not much “wrong” with this, but when I use a credit card that I don’t repay straight away, I am really in denial about my own unhealthy habits – and perhaps delusional. However more significantly, is that the wealthier I become, the more readily I can spend and the more I forget what it was to have less. I am lucky. Yes I work hard, have taken “commercial risk” but lucky even so.

I don’t judge how my clients spend their money, merely help them account for it and create planned spending. It is a very worthwhile exercise, but invariably a “painful” one…. If I asked you to sit down now and account for your spending in the last year/quarter/month, I dare say I would meet with some resistance. I often wonder why, after all, it is little more than historic information that cannot be changed. Yet it often reveals information which we probably know but would rather not see. As a nation we are quick to point to politicians claiming expenses that we think unfair, or companies that “charge too much” or “make too much profit”; how much aid is “wasted” but where does this come from? It is simply envy? Shouldn’t we start with getting our own affairs in order first?

Debt

Look, I’m not trying to be “political”. I am merely attempting to reveal that simply saying “no” is only a partial answer. I have more questions than answers and I have already confessed to you my own hypocrisy. Despite this, (perhaps in spite of this) I do believe that as a nation we need to consider why we feel the need to overspend and how we handle our own money…of course when its other people’s money, we are even more detached from it (hence the problems within financial services)….where “bankers gamble with your money” (I am repeating a phrase I have heard many times, not necessarily an accurate one)…I do know that some of my clients are very good at running a budget and sticking to it, some get frustrated with those that don’t. However, we all have our failings and whilst I am not excusing parents (for example) for failing to say no and somewhat arm-twisted by commercials aimed at children, closely followed by adverts for loans, it is a modern-day pressure which not everyone has experienced in precisely the same way. I’m not sure that banning things is a mature approach to life, but I can see an argument for banning adverts for loans during children’s TV programming, which is why I support the #DebtTrap campaign that The Children’s Society are running (which I came across over the Bank holiday weekend.

If I might therefore make a suggestion or two. Firstly, that we start with ourselves, regain control (if it was lost) or at least proper knowledge of how we spend our money. If you would like an easy to use spreadsheet for this exercise, just email me for one. Secondly, have a proper personal spending plan and if this is exceeded be prepared to ask why this was… and not just dismiss the incident as “of little significance” you may find much can be learned from your own chequebook. Do let me know how you get on…. As a final request, do check out the Children’s Society Wall of Debt campaign.

Please note that I do not provide debt advice. Despite being a financial planner, this is not my area of expertise (negotiating with creditors). If you require debt advice or someone you know does, please visit the Money Advice Service website (paid for by financial planners). Oh.. and a film currently in production with a fairly stellar cast “Suffragette” is in production.

Dominic Thomas